Kinsale

Pure play tech-led low cost operator in the US specialty insurance market with best-in-class profitability and top line growth

Company name: Kinsale Capital Group Inc.

ISIN: US49714P1084

Ticker: NYSE: KNSL

Type: Owner-Operator

Stock Price: $ 381 USD

Market cap: $ 9 billion

Review date: May 2024

Investment thesis

Kinsale Capital Group Inc. (KNSL) is the best-in-class US Specialty insurer operating in the Excess & Surplus (E&S) market. The company stands out as a remarkable business with unique combination of above industry profitability and top line growth. Key competitive advantages include exceptional discipline in the small-to-medium corporate account underwriting, technology enabled low-cost structure and superior quality of customer service. As a founder-led company, Kinsale represents business with entrepreneurial culture and management team with equal merits of talent and integrity.

Background

Founded in 2009 in Virginia, Richmond (US) the company is managed by its founder Michael Kehoe, who serves as a CEO and Chairman. Originally the company was registered in Bermuda and subsequently re-domesticated to Delaware prior to its IPO in 2016. KNSL has primarily focused on organic growth through its underwriting expertise rather than rapid expansion via acquisitions.

KNSL’s track record speak for itself. Since IPO, the insurer delivered outstanding returns compounding at CAGR of ca. +50%, way above its peers and the broader financial market.

Note: Data for 2016 begins with Kinsale's initial public offering date of July 28, 2016 and assumes reinvestment of dividends.

‘Golden age’ of E&S market

Before going into further details, let’s talk about the industry. The US Specialty or E&S market is a part of the large and mature US P&C industry with ca. $1tn premiums written in 2023. Roughly 10% of the total P&C industry handles non-standard or hard-to-place P&C risks, which standard or so-called admitted insurers refuse to write. Unlike standard risks, the involved heterogenous risks are more complex. That’s why the E&S market enjoys more freedom and less regulation in terms of price and form of a policy.

The E&S market has been growing in the past years at CAGR of ca. 20%, which some consider as the ‘golden age’ of the industry both in terms of margins expansion and top line growth. It is yet unclear, whether it is a structural or cyclical change. Probably a bit of both. On the one hand, the nature of insurance business is cyclical. The recent E&S premium rates surge will slow down and eventually reduce as more capacity will flow back to the standard market. On the other hand, we live in the world with increasing complexity. Strong demand for tackling more sophisticated risks is here to stay long-term. In any event, many industry experts agree that the E&S market is expected to grow further, but likely not at the same high pace as experienced in the past six years. The underlying forces include growth due to economic expansion, rising insurance penetartion, technological advancements, emerging risks and new products.

Source: S&P Global Inc.

In this context KNSL is still a relatively small and fast growing insurer in the E&S market. According to S&P, KNSL is 21st largest P&C insurer and 13th largest US E&S insurer. Its market share has been rapidly growing in the past years and now reached close to ca. 2% (behind Berkshire Hathaway, Fairfax Financial, Markel (see my write up here), AIG and others).

Source: S&P Global, Insurance Insider US.

Superior underwriting enabling profitable growth

How does KNSL earn its money? The company sells policies to cover insurance risks of corporate clients, which have hard time finding standard insurance coverage elsewhere. Typically it would involve newly established companies or industries, business with high risk operations, insured in litigious venues or companies with poor loss histories. Examples of KNSL’s clients include construction companies with history of losses, new restaurants, manufacturers of high hazard products like power tools, pharmaceuticals, and nutrition related products. In addition, a minor portion of the company’s revenues comes from personal lines (ca. 2% in 2023).

Source: Kinsale

Since IPO, KNSL managed to grow almost double as fast as the market, at ca. 40% p.a. KNSL’s gross written premiums of ca. $1.6bn is attributable to two thirds of Casualty business and one third of Property.

The company’s underwriting book represents a mix of lines of business geared towards commercial property, general liability, professional liability and product liability. More than 25% of the business relates to the construction industry. There is some exposure to natural catastrophe events, e.g. man-made fires, windstorms and wildfires. However, KNSL pro-actively manages its exposure to low frequency and high severity events and buys reinsurance protection externally (ca. 50% business ceded on commercial property in 2023). In terms of reserves duration, KNSL has a balance between short- and long-tail lines with an average duration of liabilities close to ca. 3 years.

KNSL distributes its insurance products primarily through brokers, while ca. 2% of premiums was generated by an in-house broker Aspera, pre-dominantly focused on personal lines. The top 3 brokers accounted for ca. 50% of gross premium written in 2023 (incl. RSG Specialty, AmWINS Brokerage, CRC Commercial solutions). This concentration is not ideal, but very typical for the commercial US P&C market in large. The average size of KNSL’s brokerage commission at ca. 14.5% of premium in 2023 is at the lower range compared to many peers.

So what is the reason behind the KNSL’s success disrupting the industry? KNSL is a great example of a company, which embodies focus. The company provides insurance risk coverage with the clearly defined strategy:

100% focus on E&S market

Hard-to-place risks

Small-to-medium size accounts

Proprietary technology with integrated digital platform without legacy IT systems

No delegated underwriting authority

Unlike many established large E&S insurers, KNSL does not write standard (or admitted) risks, with 100% of its premiums coming from the E&S market. KNSL focuses on small and mid size accounts, which tend to have less competition and higher operating margins. An average KNSL’s premium per policy amounted to ca. $15,200 in 2023 ($ 16,200 excl. personal lines). The big traditional players usually choose to stick to larger corporates due to the embedded cost efficiencies with higher volume of premium written per deal. KNSL is a contrarian in this sense and deliberately serves the small-to-mid size client base with much higher volume of transactions. For instance in 2023, it handled 735,000 policy submissions, of which 489,000 were quoted (66.5% quote to submission ratio) and 53,000 were bounded (7.2% bound to submission ratio) considering the relatively modest headcount of 574 FTEs. This result is remarkable for the industry.

One of the reasons why KNSL managed to stay cost efficient and scale significantly in the past years is its reliance on the proprietary technology with integrated digital platform. Making a quote to a broker for KNSL is matter of 24 hours, while for many established insurers this may take up to some days, if not weeks? In addition, KNSL growth was primarily organic, hence the company did not have to deal with integrating legacy IT systems. The latter issue is common for M&A driven peers with decades of legacy on their book. The combination of clear focus on the niche customer group combined with superior IT capabilities, allows KNSL to benefit from its low-cost operator strategy and outperform peers by a lofty margin. On average, KNSL expense ratio was at ca. 22% in the past 5 years, the lowest among direct peers. More importantly, the cost advantage will be even more pronounced, if E&S market cycle turns from ‘hard’ to ‘soft’ and premiums rates start declining.

*Based on companies’ filings aggregated by segments by myself, incl. Berkshire Hathaway Primary Group, Fairfax North American Insurance (incl. Crum & Foster, Zenith National and Northbridge), AIG North America, WR Berkley Insurance, Cincinnati Financial E&S.

What else KNSL does differently? Unlike most insurers underwriting small-to-medium accounts, KNSL does not delegate underwriting authority to agents, brokers or any other third parties. It handles critical underwriting processes in-house, incl. risk selection, price-risk matching, claims handling etc. This not only saves KNSL other few %-points on brokerage commissions, but also keeps the company closer to its core competency, i.e. insurance risk. In addition, delegated underwriting often comes with a potential conflict of interests because third party agents and brokers often get paid commissions based on volume of premiums, but not profitability of the underlying business. Also by performing the core underwriting activities in-house KNSL has an advantage of broader risk terms versus tighter policy conditions which are more common among agents and brokers. In the past 5 years, KNSL loss ratio at ca. 58% was among the best for peers.

*Based on companies’ filings aggregated by segments by myself, incl. Berkshire Hathaway Primary Group, Fairfax North American Insurance (incl. Crum & Foster, Zenith National and Northbridge), AIG North America, WR Berkley Insurance, Cincinnati Financial E&S.

To summarise, KNSL’s business model emphasizes underwriting profitability over premium growth. As a business with superior expense base and better loss experience, KNSL’s operating results are best-in-class the industry.

*Based on companies’ filings aggregated by segments by myself, incl. Berkshire Hathaway Primary Group, Fairfax North American Insurance (incl. Crum & Foster, Zenith National and Northbridge), AIG North America, WR Berkley Insurance, Cincinnati Financial E&S.

Also KNSL demonstrated prudent reserving practices with consistent favourable loss reserves development from prior years. Since IPO, the company released total of ca. $160m net loss reserves into profit, on average ca. 5% of premiums earned annually. In other words, the insurer’s estimate of future claims was conservative with more reserves placed on the balance sheet than actually needed to settle claims.

This is especially encouraging given the recent challenges related to the rising loss cost trends faced by the US P&C industry (i.e. social inflation and economic inflation). In the past years many peers took drastic actions to strengthen reserves for in-force US Casualty lines, more pronounced in commercial auto, professional liability, product liability and directors and officers liability lines of business.

‘Boring’ investments

Like many traditional insurance companies, KNSL has a relatively conservative investment profile, with more than 90% of assets invested in liquid asset classes, i.e. cash, T-bills and other fixed income securities.

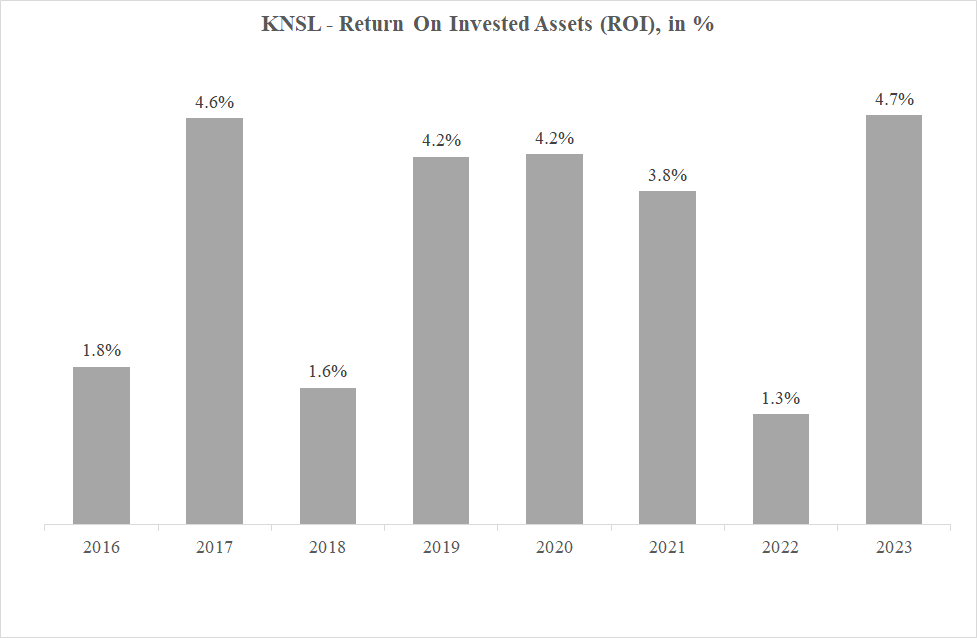

The company is clearly focused on capital preservation rather than optimising investment returns while maintaining a healthy balance sheet. Since 2016, KNSL’s investment returns averaged out close to ca. 3%, pretty much following the US risk-free rate dynamics.

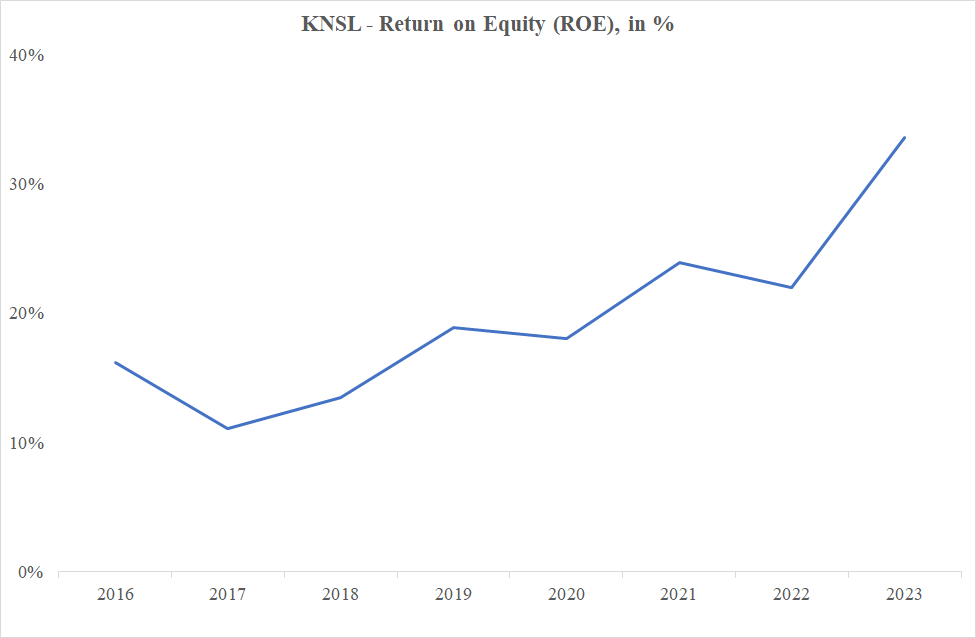

As a result, the superior underwriting combined with solid investment performance translated into very strong profitability for the entire group, with an average ROE of ca. 20% p.a. since IPO.

‘Fanatical’ leadership

Much of the KNSL’s success is attributable to the leadership team. Management has good reputation within the industry and on average +30 years of experience.

Michael P. Kehoe, the founder and CEO, has been instrumental in shaping Kinsale's strategic direction and corporate culture. Prior to founding Kinsale M. Kehoe was a CEO of James River (2002-2008), the Kinsale’s direct competitor. There he closely worked with Brain Haney, the former Chief Actuary of James River (2002-2009) and the current COO of KNSL. Both individuals are well regarded in the industry as top notch talent. The team has some qualities of the ‘fanatical’ management, incl. passion of what they do and how they engage with people (see a wonderful interview of Guy Spier with Ejnar Knudsen touching this topic).

As a meaningful owners of KNSL, the management team ‘eats its own cooking’ and has closely aligned interests with external stockholders (ca. 5.6% of the company owned by management, of which ca. 4% by Mr. Kehoe as per latest proxy statements).

In terms of compensation, KNSL management team does not have excessive compensation packages. The highest paid employee was the CEO Mr. Kehoe with total compensation of close to $5.2m in 2023, much of it is in a variable form tied to the stock performance. The management incentives are mainly focused on the business profitability and include KPIs like underwriting profit, combined ratio and operating return on equity.

What else to like about KNSL? It’s entrepreneurial culture with strong emphasis on integrity, innovation, and customer service. The company recognises achievement, rewards the doers and removes underperformers. KNSL promotes key leadership roles from inside, which demonstrates its commitment in recognising and rewarding own talents (see the latest promotions in 2024 of S. Winston as Chief Underwriting Officer and P. Dalton as Chief Business Development Officer)

The insurer’s capital allocation strategy focuses predominantly on deploying capital for organic and profitable growth, while maintaining strong balance sheet without much debt. The company has consistently increased its dividends, reflecting a stable and growing payout history since 2016. KNSL’s dividends amounted to ca. $0.15 per share for the fiscal year 2023, or ca. 0.16% dividend yield and ca. 4% dividend payout ratio. Since 2016, there were no related party transactions of concern or any acquisitions with own stock.

Valuation

Too bad, KNSL is not a cheap company. The stock is traded at eye-popping valuations for the industry at 7.5 P/B and MCAP to EBT 12-months trailing close to ca. 25x. The common valuation for commercial insurance peers is around P/B of 1.5x and P/E close to 10x. Clearly, KNSL is priced for growth. The question is whether the current valuation is still justified?

*CR: Berkshire Hathaway Primary Group, Fairfax North American Insurance (incl. Crum & Foster, Zenith National and Northbridge), AIG North America. Horizontal axis: P/BV based on May 10, 2024 (Source: Tikr.com). Vertical axis: 5y average combined ratio. Bubble size: DWP (Source: S&P Global).

Kinsale’s story reminds me of Progressive (PGR) in the US personal auto space. Historically, PGR grew its written premiums from $23m in 1965 to $51bn in 2023. Thanks to its low cost strategy rooted in the technology and relentless focus on the profitable underwriting, the company managed to change status quo in the mature personal auto space. In the past 15 years, PGR doubled its market share from 7.5% to close to 15% biting in to the pie of the big established market players like Stat Farm, Allstate, USAA, etc. Despite of the relatively rich valuation with high P/B and P/E multiples, PGR delivered compelling returns, i.e. stock price more than 10x-times in the same period. Similar to PGR, KNSL seems to apply the same playbook with emphasis on low cost structure, technology, innovation and customer service.

Depending on the future growth and interest rates assumptions, the fair value of KNSL’s operating earnings combined with investment returns varies as outlined in the matrix below. Based on my simple valuation, currently Mr. Market is pricing for KNSL at least +20% EPS target growth vs. historical growth of ca. 35%.

Source: My own model assuming 10 years EPS growth. No terminal value.

Source: TIKR

For those investors with a bullish view on the E&S industry growth related tailwinds and KNSL’s continuous ability to outperform the market the current price may come across as fair. As a quality business with a long runway, KNSL is worthwhile consideration to me. Since I do not aim to time the market, there is no reason to get upset about a potential short-term decline in the stock price. As Warren Buffett used to say: “When it goes down we love it, because we'll buy more”.

Key risks

Kinsale is a great business, but it’s not without some risks:

Operational risk: Succession risk to Mr. Kehoe, who is clearly instrumental to the company’s success.

Cyclical risk: Downturn in the E&S market with more capacity going back to admitted market and less risk passed on to non-admitted carriers.

Competition from new and established players.

Regulatory and legal risk: KNSL is sensitive to any adverse changes in the regulatory and legal system, incl. legislation changes, jury award practices, etc.

Risk of unknown…. Who knows which genie is out of the bottle this time?

Disclaimer: The material and analysis in details herein is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. All facts and statistics are from sources believed reliable, but are not guaranteed as to accuracy, completeness or timeliness in the information. The author has or had positions in the company and her positions may change over time without notice.

Excellent article, Mariya!