International General Insurance (IGIC)

The hidden gem insurer - Unknown, misunderstood or unloved?

Intro

Those of you who have read my previous posts on Kinsale and Markel will have noticed my particular interest in the Excess & Surplus (E&S) insurance market. Despite the recent surge in P&C market valuations I still believe it is a nice pond to fish. Driven by economic expansion, emergence of new risks, digitalisation, energy transition, and factors related to climate change the sector is poised to grow at least in line with GDP, if not more. With this in mind, I am looking for well-managed insurers with a bias towards founder/owner-led businesses run by great people focused on the long-term value creation. Here is another candidate to consider.

Company name: International General Insurance Holdings Ltd.

Ticker: NASDAQ: IGIC

Type: Owner-Operator

Stock Price: $ 24.4 USD

Market cap: $ 1.1 billion

Review date: December 2024

Investment thesis

International General Insurance Holdings Ltd. (IGIC) is a Bermuda-based niche P&C insurer with a superior underwriting track record of consistent and disciplined profitable growth. Under the leadership of a highly invested and aligned founding family with over 30% ownership stake, IGIC has delivered annual total returns in excess of 30% and an average ROE of +15% since going public in 2020. This has been predominantly funded by operating cashflows aided by organic growth. Despite its past success, a debt-free balance sheet and ample future growth opportunities in the global specialty (re-)insurance markets, IGIC trades at a significant discount to its peers and the broader market.

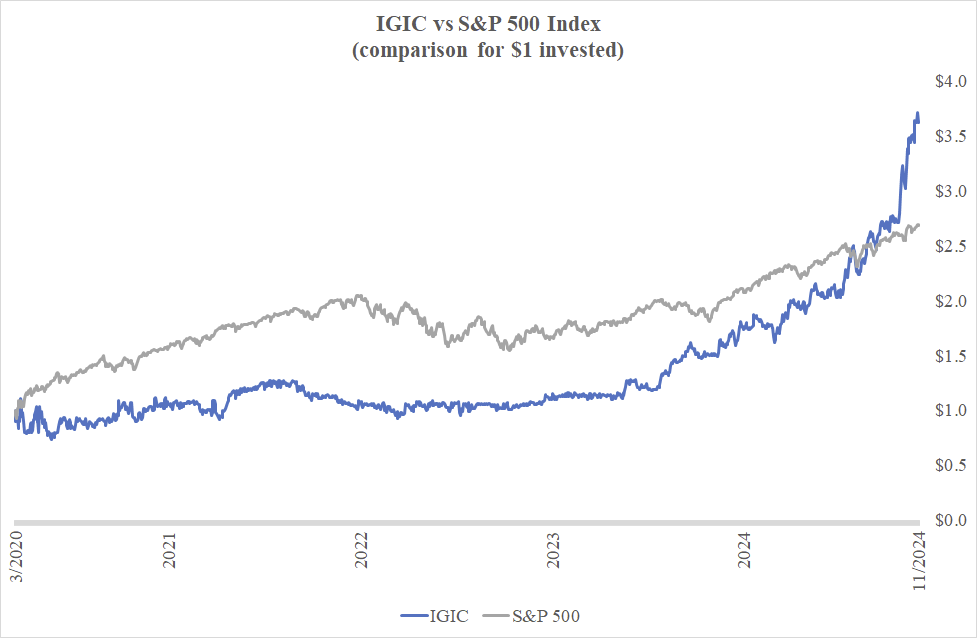

Source: Own analysis. Data for 2020 begins with IGI's going public dated March 18, 2020 and assumes reinvestment of dividends.

Background

IGIC is a Bermuda-domiciled company with origins in the Middle East in Amman, Jordan. Although it has only been a public company for four years, the insurer’s history dates back to more than 20 years of steady and consistent growth under the leadership of the Jabsheh family.

Back in 2001, energy-insurance veteran Wasef (82) founded a small insurer with a starting capital of $25m, while his son Waleed (48) joined him shortly afterward. The focus was on providing risk coverage against accidents for onshore and offshore oil drillers as well as downstream refining facilities in the Middle East. Since then the company has evolved from a tiny niche monoliner writing $10m premiums from energy lines to a multinational P&C insurer with ca. $700m of gross premium written active in 25 P&C lines of business in 200 countries.

The transition did not happen in one go. IGIC has pursued two decades of slow and steady expansion with the ‘underwriting first’ philosophy in mind. Management maintained a laser-like focus on writing profitable policies rather than chasing growth at all costs.

Once it laid down a strong foundation of disciplined underwriting in the domestic market, it began expanding internationally. In 2007, IGIC entered the UK market with the acquisition of SR Bishop Underwriting (renamed to North Star Underwriting). From 2005 to 2016, the company grew its premiums almost tenfold from $25m to $240m through further expansion into Europe, Asia and South America. As another major milestone, IGIC made its way to the US in 2017, cautiously seizing the opportunity as premium rates expanded in the US E&S market.

More recently, the company acquired Energy Insurance Oslo, a Norwegian managing general agent (MGA), which has been an exclusive service provider to IGIC since its launch. In addition as of May 2024, IGI rents a company ‘box’ (330A) at the Lloyd’s marketplace to enhance its distribution capabilities of insurance and reinsurance business globally (not a part of Lloyd’s syndicate as a regulated unit).

Naturally, by spreading its geographic footprint IGIC has also added new lines of business such as professional indemnity, marine cargo, ports and shipping terminals, financial institutions and treaty reinsurance. The company has transitioned from a small Middle Eastern insurer to a mid-sized global specialty player with eight offices and +460 employees worldwide.

Despite its Jordanian origins, IGIC is legally a Bermuda company, which owns a holding company based in Dubai International Financial Centre (DIFC), a self-regulated zone outside the United Arab Emirates. This intermediate holding company owns IGIC’s main operating entities in the UK, Bermuda and Dubai, as well as a back-office arm in Jordan. As a result, IGIC’s insurance operations are regulated by respected local authorities like the Bermuda Monetary Authority (BMA) and the UK Financial Conduct Authority (FCA), which underline the insurer’s international profile.

Since its inception, IGIC has only raised capital twice, including $75m from a private placement in 2007 and ca. $40m of proceeds from going public in 2020. The rest has been achieved organically, which is quite impressive.

The IGIC as a public company was born in a merger with SPAC. This fact may discourage some institutional investors from digging any further, but I have no such concerns for the following reasons:

- This was a purpose-built insurance SPAC (Tiberius Acquisition Corp).

- The SPAC sponsors are seasoned professionals in the insurance industry. M. Gray (CEO, Gray Insurance Company) and A. Poole (Diamondback Capital Management, SAC Capital and Swiss Re) have not only maintained their original position in IGIC, but have increased their holdings in recent years. The total combined stake is close to ca. 7.3% according to YE2023 filings.

- There is no SPAC baggage left to dilute the interests of the current shareholders. When IGIC went public through a merger with Tiberius, it issued private and public warrants and earnout shares to the original owners and SPAC sponsors. The warrants were subsequently purchased and redeemed in 2023 and all earnout shares are now fully vested (vesting at a share price of between $11.5 and $15.25 and well above the SPAC offering price of $10).

- The founding Jabsheh family has not only remained operationally active, but has also retained its majority shareholding. Wasef serves as a Chairman (prior to July 2023 as a CEO) and three of his sons are currently working in IGIC, incl. Waleed (48) as CEO, Hatem (45) as COO and Ahmed as IR representative.

Since going public, IGIC has delivered solid total returns of threefold, growing at +30% per annum and outpacing the S&P 500 benchmark, particularly in the past year.

Unique geographic and business mix

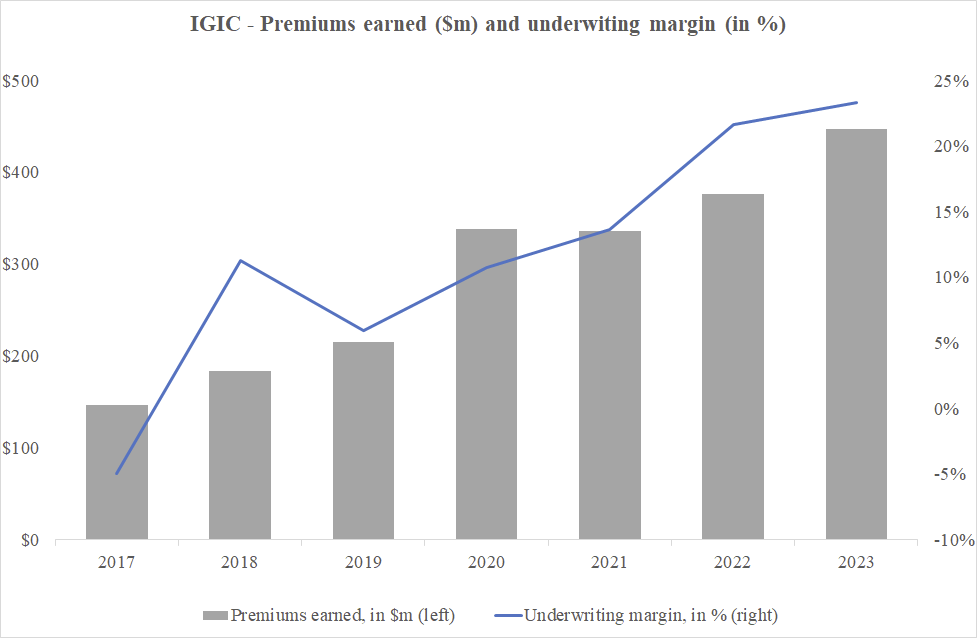

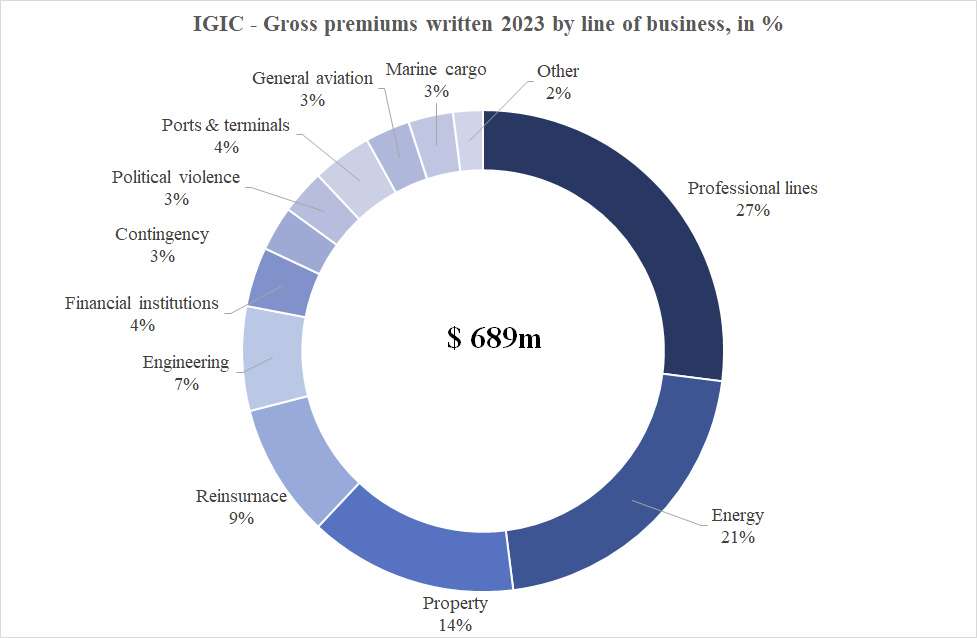

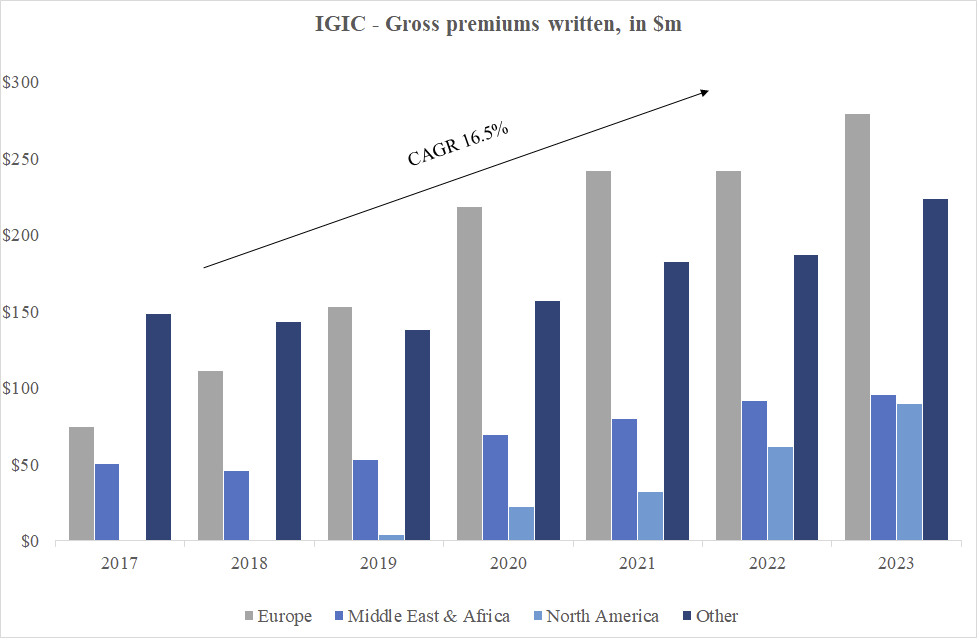

First things first, let’s start with how IGIC earns its money. Since 2017, the insurer has profitably grown its premium earned to ca. $450m at an annual rate of 20% aided largely by organic growth. Today, IGIC offers 25 lines of business in 200 countries operating from 8 operating offices. The insurer’s focus is on commercial facultative business, no personal lines involved.

Source: IGIC, own analysis.

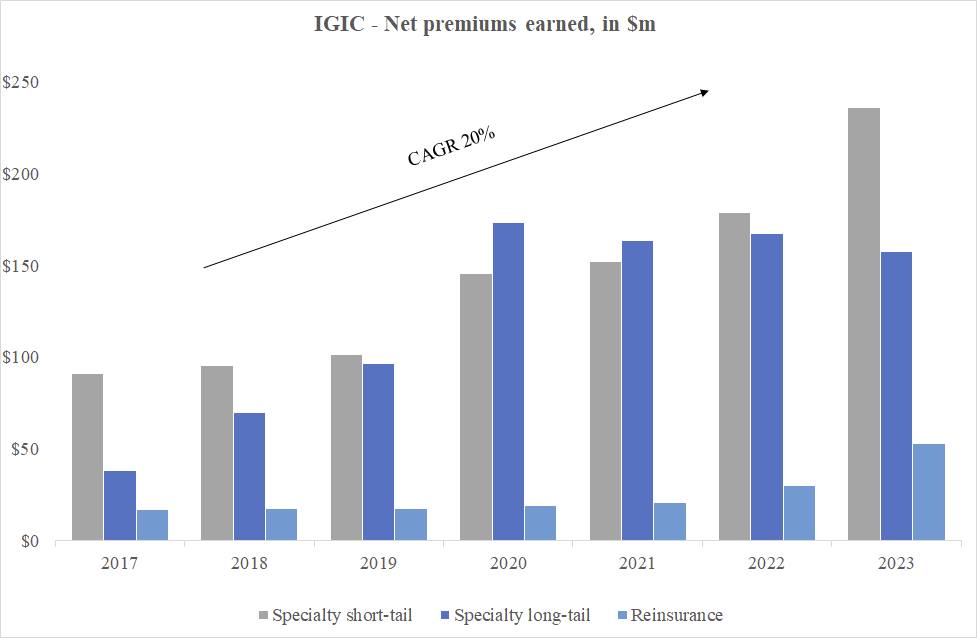

The company’s bread and butter business is short-tail insurance (ca. $250m or 53% of 2023 net premiums), which refers to policies that cover claims that are settled in a relatively short period of time, typically less than 12 months. This segment covers energy (offshore, onshore, power and renewables), commercial property, construction, general aviation, port and terminals, marine cargo and other. The advantage for IGIC of writing short-tail policies is that they offer short turnaround time, higher visibility on claims outcome, and the ability to react faster to dynamic market conditions. This segment is core to IGIC’s business model and will like to grow further.

Another pillar of IGIC’s revenues is long-tail insurance, which accounts for just over $150m or 35% of 2023 net premiums. Most of this comes from professional indemnity and financial institutions. Examples of risks involved include professional malpractice claims arising from errors and omissions (E&O) and poor choices or committed negligence by directors and officers (D&O). Generally, long-tail business claims payout pattern stretches beyond 12 months with final settlements occurring multiple years after the policy is written. As a result, one can assume that IGIC deals with a higher degree of uncertainty in determining its claims liability. Does this translate into a higher risk? Not necessarily, if the company specialises in the respective sub-segment and has a distinct edge in assessing the underlying risks. So far, IGIC has grown its long-tail segment at healthy rates and started scaling down its business as of 2020 as the industry’s premium rates start losing momentum.

Source: IGIC, own analysis.

The remaining 9% of premiums come from reinsurance, the sale of insurance to insurers. After years of poor results due to the heavy burden of unprecedented natural catastrophe losses and wider reserving issues in some US casualty lines, the average return on equity of global reinsurers was 6%, below their cost of capital (see Guy Carpenter’s report). As a result, the reinsurance market braced for a surge in pricing. That’s when IGIC decided to seize the opportunity, tripling its reinsurance since 2017 from $17m to ca. $50m. This segment is currently the brightest growth pillar of the IGI’s portfolio.

Source: IGIC, own analysis.

To date, IGIC has demonstrated a solid track record of diversifying its portfolio not only by line of business but also by geography. More than half of the insurer’s premiums come from the UK (28% of GWP), Europe (12%) and North America (13%), with the remainder of the business spread across Asia Pacific (13%), the Middle East (9%), Central and South America (11%) and Africa (5%). As you may note, IGIC’s unique geographic profile allows it to benefit from enhanced diversification and reduce the inherent volatility of its underwriting results.

Source: IGIC, own analysis.

Roughly two-thirds of the business is written in-house, while 24% is delegated to third-party MGAs and the remaining 9% is reinsurance. Unlike Kinsale, which does not delegate its underwriting authority to third parties, IGIC uses external underwriters. Why so? Probably to have easier access to new markets and/or lines of business in a cost-effective manner. Based on the company’s IR comments there is an in-house team which manages MGA accounts and ensures strict guidelines for delegated underwriting.

‘Underwriting first’ model

Throughout its more than 20-year history, IGIC has done a masterful job of expanding its footprint and entering new lines of business. What’s behind this success?

First and foremost, disciplined underwriting with a clear understanding of its own capabilities. The company refers to its ‘underwriting first’ philosophy, which prioritises profitability over volume growth.

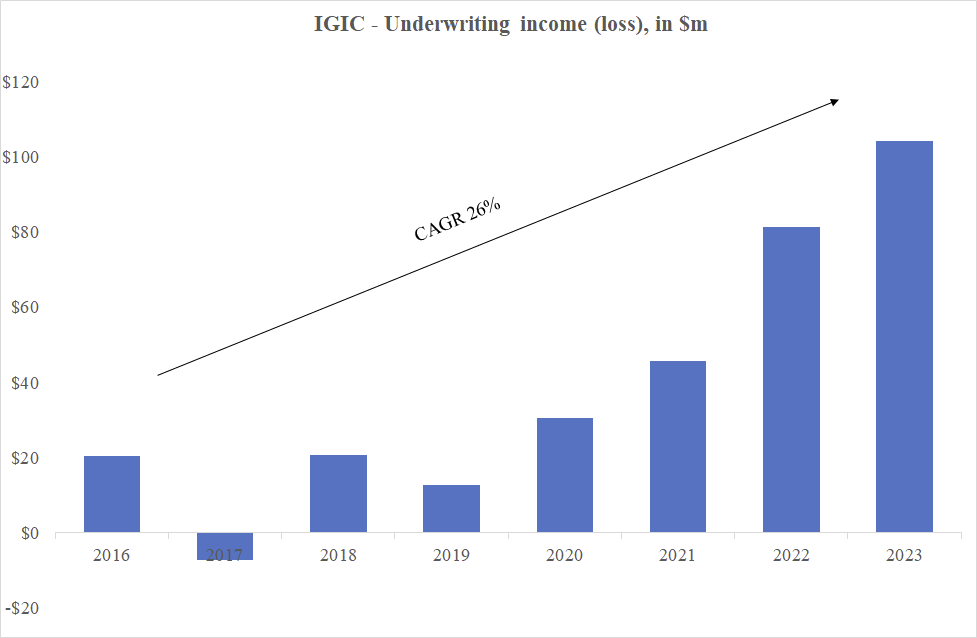

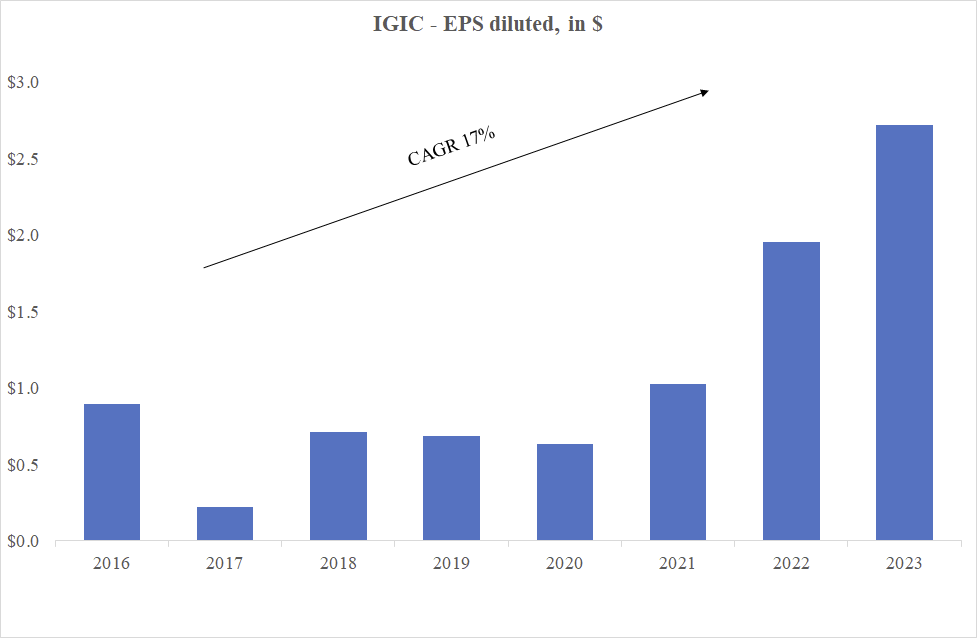

Indeed, IGIC has demonstrated a solid track record. Since 2016, its underwriting income has grown at a CAGR of +25% to around $100m, with only losses reported in 2017, the year of higher than expected weather-related losses from hurricanes Harvey, Irma and Maria.

Source: IGIC, own analysis.

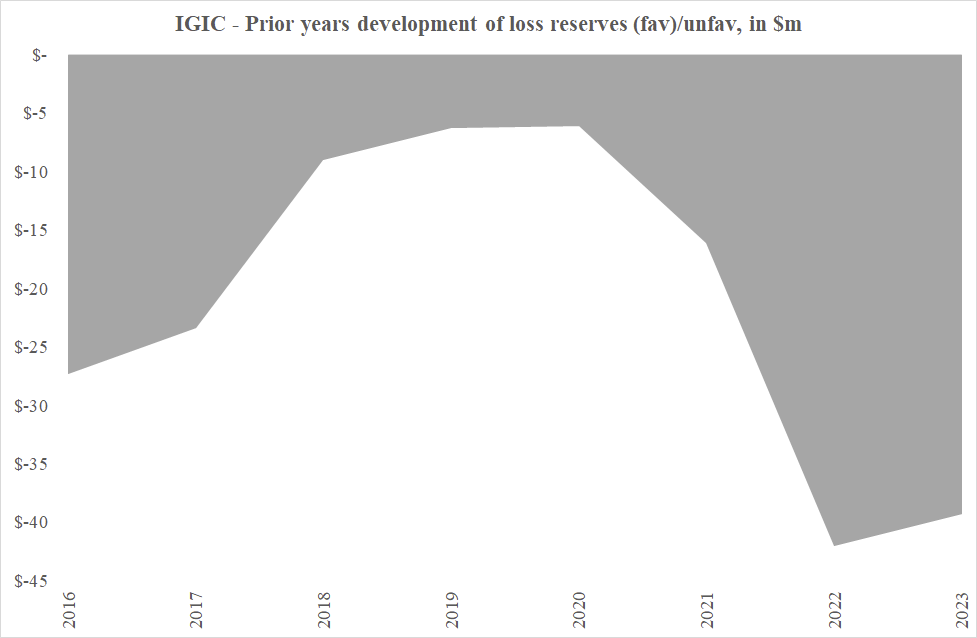

This is also evidenced by more than a decade of consistent reserve releases, which amounted to ca. $ 170m since 2016, or an average of 8.5% of earned premiums.

Source: IGIC, own analysis.

When entering new markets and lines of business, IGIC proves to be cautious about scaling volumes, choosing to build local market expertise without compromising its core business. For example, after more than seven years in the US market, IGIC has restricted itself to short-term lines of business, avoiding writing some of the commonly perceived ‘toxic’ long-tail US casualty lines affected by rising social and economic inflation (e.g. commercial auto, excess and umbrella). In addition, the insurer writes policies on a claims-made basis, which means that claims can only be made during the period covered by the policy and cannot surprisingly emerge years after. This provides greater certainty as to the ultimate amount of IGI’s insurance liabilities and enhances the company’s ability to respond promptly to new opportunities.

Second, the discipline to manage cycles skillfully, scaling back business in soft market years and deploying more excess capital when rates are favourable. IGIC stands out as a nimble player that seeks out market dislocations and shifts capacity to the lines with the strongest rate momentum and highest margins.

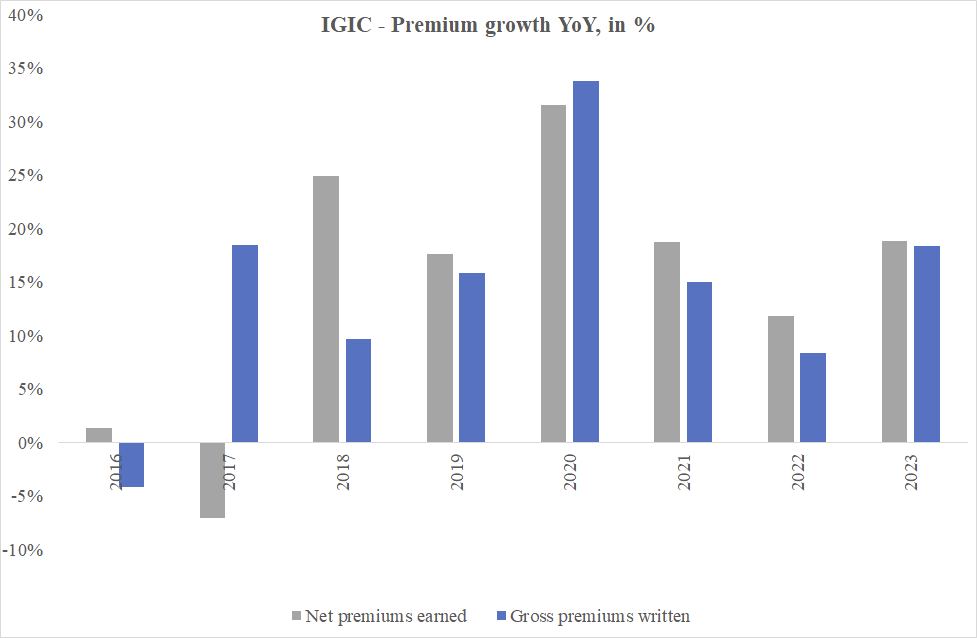

To illustrate this, let’s look at the years from 2014 to 2016, when the market was going through a difficult period. As the chart below shows, IGIC not only reduced its retained premiums by writing less business on a gross basis, but also increased its use of external reinsurance, thereby removing risk from its balance sheet (see the difference between gross and net premiums). It’s good to see that the management is not shy to scale down the business and behaves rationally, demonstrating remarkable discipline and patience.

Source: IGIC, own analysis.

In another example of cycle management, from 2017 IGIC seized the opportunity by scaling up its US operations and driving premium growth when E&S premium growth rates were in the double-digits. During this period IGIC’s US written premium grew 80-fold from $2m in 2017 to $90m in 2023. In addition, the company has seen notable market dislocation in reinsurance in recent years, IGIC doubled down on the reinsurance business taking advantage of the favourable rate momentum.

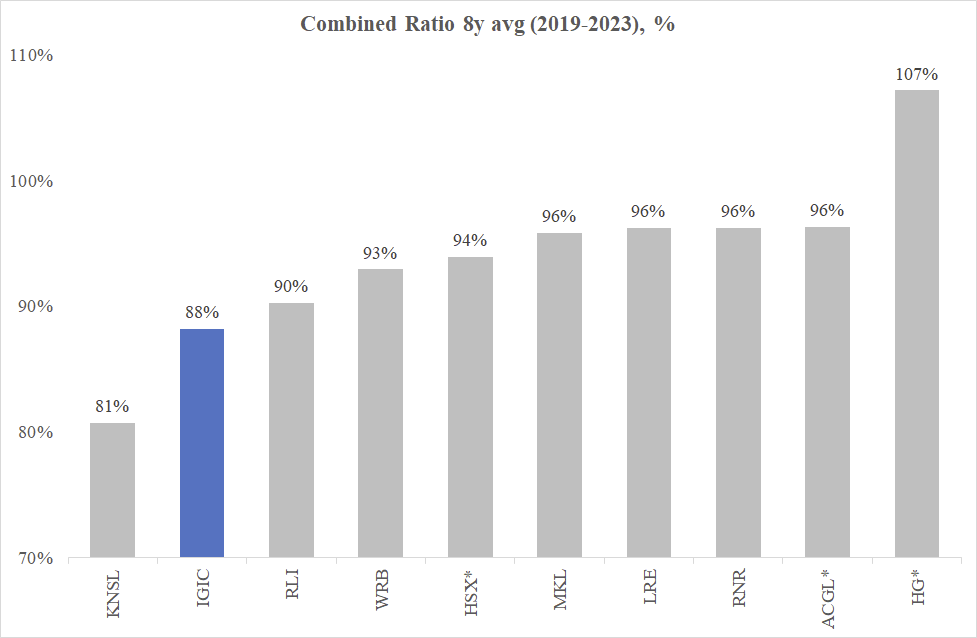

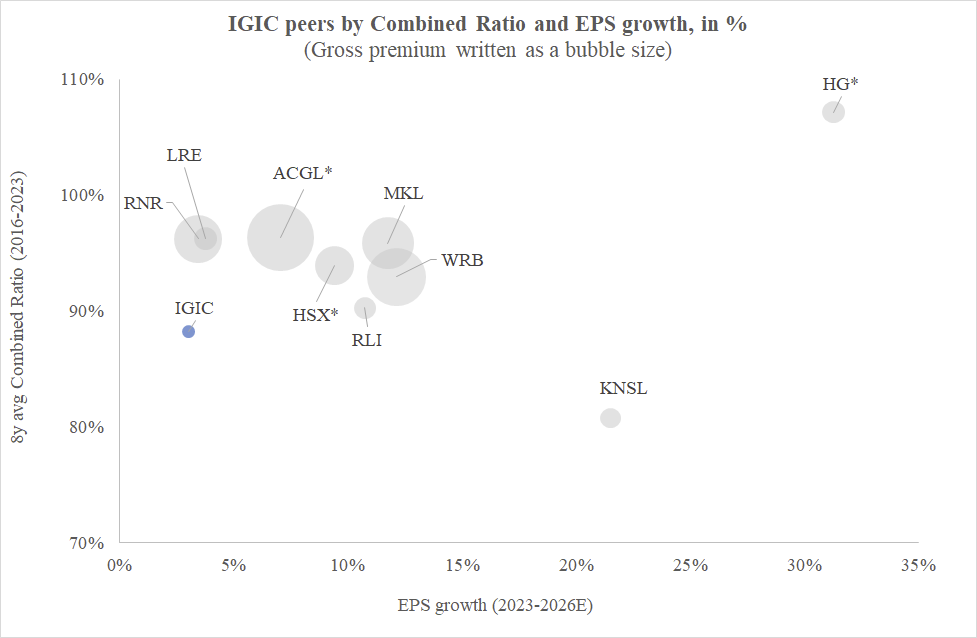

How does IGIC perform against the competition? Given the insurer’s unique geography and business profile, it’s difficult to find direct peer comparisons, but I’ve managed to select a few. Over the past eight years, IGIC’s average combined ratio has been remarkably close to 88%, the second only after Kinsale’s 81% and well below 100% (read ‘profitable underwriting’).

Source: Own analysis based on companies’ filings. *For comparative reasons HSX includes Hiscox London Market segment only, ACGL includes Insurance and Reinsurance segments (excl. Mortgage insurance), HG's combined ratio is 5y average as data available only since 2019.

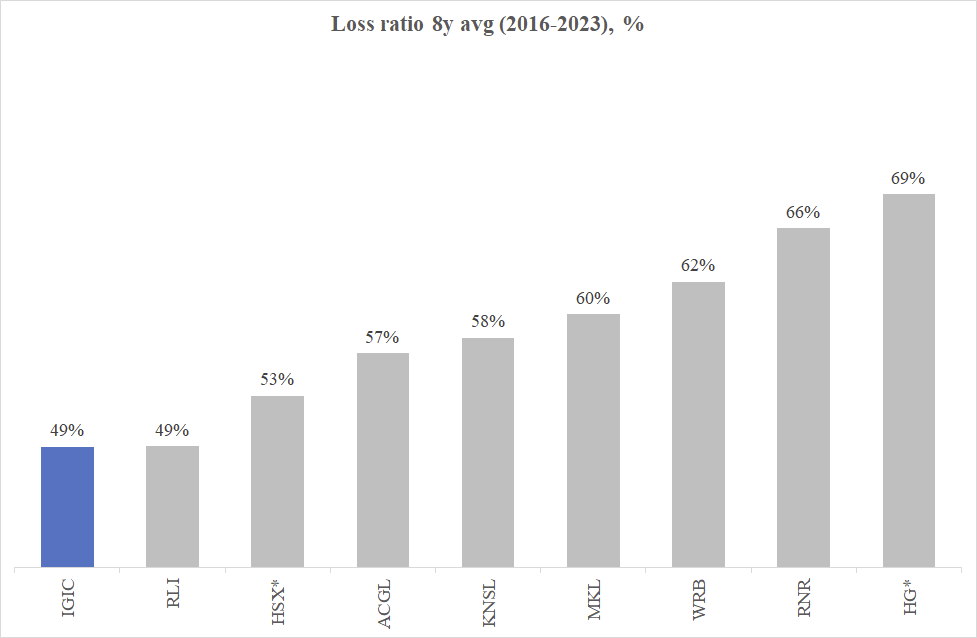

The IGIC's remarkable combined ratio was the result of a relatively low loss ratio of ca. 49%, well below its peers. This is truly impressive.

Source: Own analysis based on companies’ filings. *For comparative reasons HSX includes Hiscox London Market segment only. HG's loss ratio is undiscounted 5y average as the data available only from 2019.

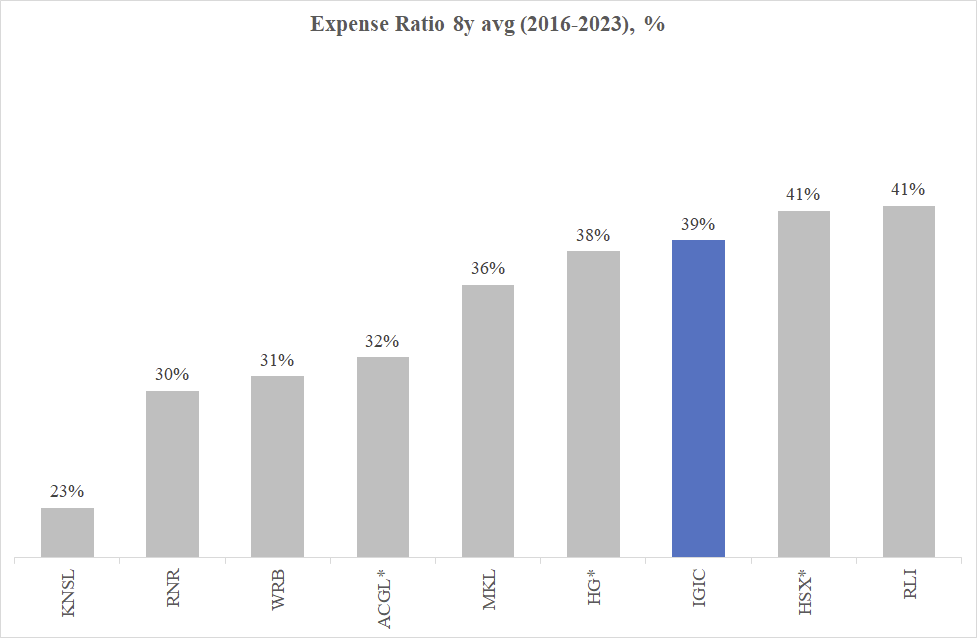

When it comes to cost efficiencies, IGIC is in the middle of the pack. Although one might think that IGIC has an embedded cost advantage with staff based in places such as Jordan, Dubai and Malta, the company’s international growth ambitions mean that more new underwriting talent is being recruited in higher-cost locations such as London and Bermuda.

Source: Own analysis based on companies’ filings. **For comparative reasons HSX includes Hiscox London Market segment only. HG's expense ratio is undiscounted 5y average (available from 2019 only).

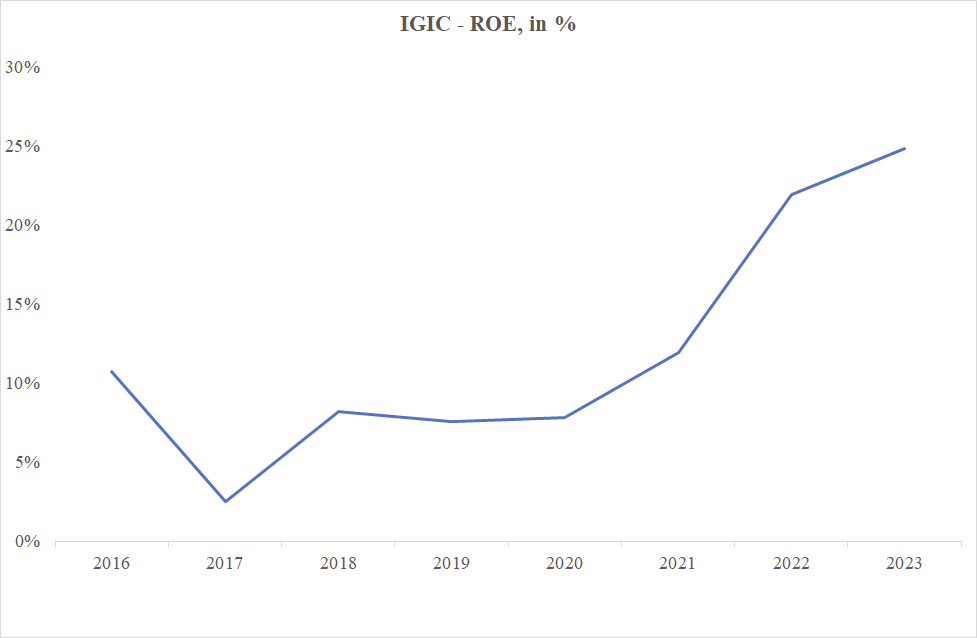

As a result, the superior underwriting combined with solid investment performance translated into very strong profitability for the entire group, with an average ROE of approx. 12%.

Source: IGIC, own analysis.

Boring investments

Like many traditional insurance companies, IGIC has a relatively conservative investment profile. Over 95% of its $1.15bn of invested assets are in bonds, term deposits, cash and other short-term investments. The bond portfolio has an average credit rating of ‘A’ rating and a duration of ca. 3.4 years, which roughly matches its insurance liabilities. This means that the risk of loss from credit defaults or interest rate movements is relatively low.

At the year-end 2023, the investment yield amounted to ca. 3.9%. Since 2016, the blended return on invested assets has averaged close to ca. 2%. To avoid any doubt, the IGIC’s investment strategy is not about maximizing investment returns, but protecting a solid capital base for the ‘underwriting first’ business. That’s why a few percentage points of the company’s steady investment returns add nicely to its excellent underwriting results.

Highly invested management

IGIC’s success as one of the best underwriters in the industry is largely due to the leadership of the founding Jabsheh family. What sets them apart from their peers? In my opinion, it is underwriting discipline, entrepreneurial spirit, patience and self-awareness.

So what to like about IGIC’s management?

Aligned interests: The company has been built from the ground up by the father (Wasef) and his son (Waleed), who are heavily invested in the business, both financially and emotionally. The two of them together own around 32.3% of the company at year end of 2023 or the equivalent of ca. +$350m (Wasef 31.2% and Waleed 1.1%).

Heartbeat in insurance: Both leaders have extensive backgrounds in the industry. Prior to IGIC, Wasef successfully started new companies and sold them to larger established insurance players. In 1989, he established Middle East Insurance Brokers and two years later founded International Marine & General Insurance Co., both taken over by Houston Casualty Company (HCC), now a subsidiary of Tokyo Marine – where he also served as a HCC’s Board Director until 1997.

An entrepreneurial culture with the ability to be nimble and to seize opportunities as they arise. The choice of new lines, geographies and timing of cycle management is an undeniable strength of IGIC’s management team.

A high degree of conservatism shines through a consistent history of peer-leading underwriting performance and a clean balance sheet. Imagine zero financial debt and business growth funded by primarily operating cashflows.

Management incentives centered around profitability. Based on management comments internal performance is measured purely on underwriting, while investment results are not factored in.

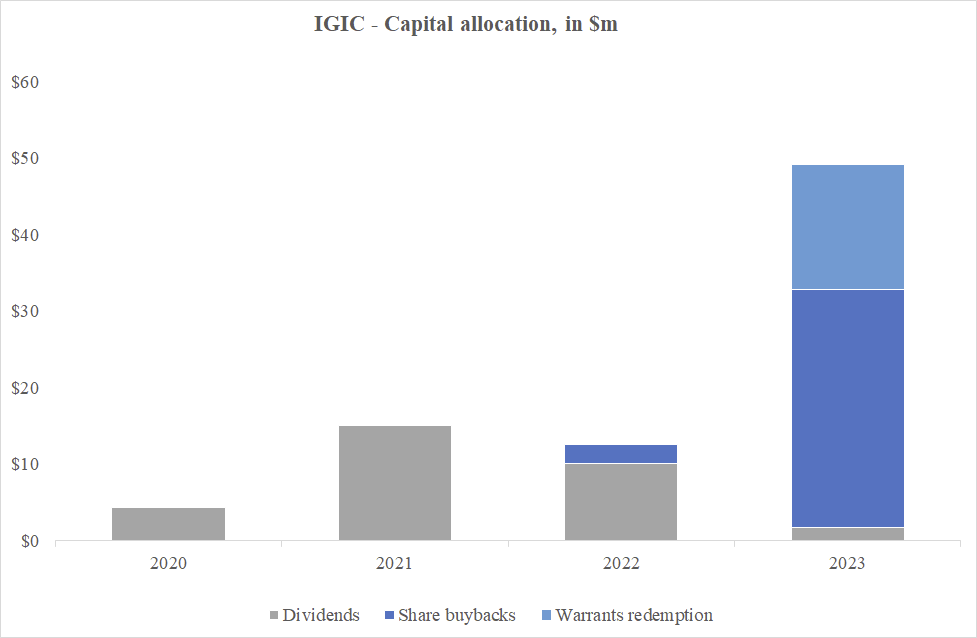

Rational capital allocation. IGIC has a track record of rational and shareholder-friendly capital allocation, prioritising organic business growth. Dividends and share buybacks are in the management playbook as a means of returning excess capital in the absence of any better opportunities. Since 2020, IGIC has paid a total of $39m in dividends and $31m in share buybacks. Before going public IGIC had an unofficial dividend payout ratio of close to 40%, with the majority of capital generated being reinvested in growth. At the end of 2023, the dividend yield was around 0.3%, with share buybacks and the purchase of warrants taking precedence.

Source: IGIC, own analysis.

In 2023, IGIC wisely bought back dilutive warrants from the SPAC transaction. The only reason why the management could spend $16m on expiring warrants is if they believe the fair value of the company is higher. Also based on recent management comments, we should expect the company to continue to buy back shares as long as they trade at a discount.

What are my few reservations? Related party transactions. Although there are no known major related party transactions of concern, there are a few minor ones that caught my attention. In particular, IGIC has accounted for the rental of a private boat for business promotional purposes (entertaining clients at the Monte Carlo annual meeting?) and aircraft management fees from a private jet company Arab Wings controlled by Wasef Jabsheh with a total of approx. $2.4m to be expensed to the company’s general and admin account between 2015 and 2021. As much as I am happy for the people who use such transport services, as a shareholder I prefer this type of expense to be covered from a personal account.

Valuation

IGIC trades significantly cheaper than its peers with P/E of 8.0x and P/B of 1.7x multiples pricing rather modest growth. This is particularly interesting considering the consistent earnings history, conservative balance sheet, entrepreneurial culture and aligned management team.

Source: Own analysis, companies’ filings, Finchat (dated Dec 11, 2024).

What is already priced in? Mr. Market expects EPS growth of 5% (2023-22026e), which seems a stretch to me given the historical EPS CAGR of +15% and the future growth prospects, including upside from further expansion in the US short-tail lines and reinsurance market where conditions remain favourable.

Source: Own analysis, companies’ filings, Finchat (dated Dec 11, 2024).

With the expected 2024 EPS of $3 and current share price $24.4, you get a return of 12% The upside lies in continued EPS growth supported by disciplined underwriting, improved business scale and potential multiple expansion closer to the peer group (P/E of 10-15x?). If the market fails to recognise this, then I do not mind management continuing to buy back shares, thereby increasing shareholder value per share.

Source: IGIC, own analysis.

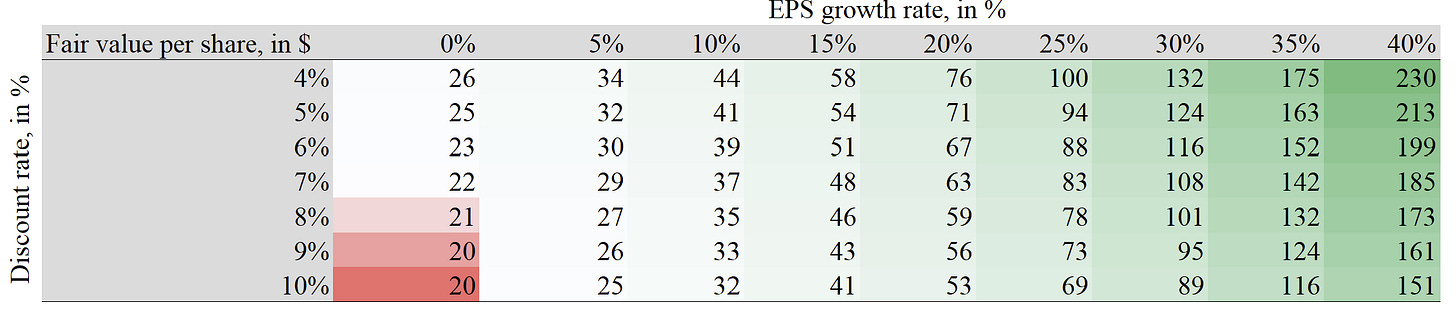

Depending on the future growth and interest rate assumptions, the fair value of IGIC’s operating earnings combined with investment returns varies as showned in the matrix below. Based on my simple valuation, IGIC’s fair value is closer to $50 per share, with a mid-term IRR of at least +15% and an upside potential of at least 50%, not including any future share buybacks.

Source: My own model assuming 10 years EPS growth. No terminal value.

Why does the opportunity exist?

- Limited coverage: After four years of listing on NASDAQ, IGIC is covered by only three analysts (Dowling & Partners, Oppenheimer & Co and RBC) and is not yet on the radar of large funds.

- Middle East perception: Given its Middle Eastern origins, the insurer may still be perceived as a local company. This is no longer the case due to its successful international expansion and reduced relative exposure to the region.

- SPAC ‘birthmark’: Indeed, many institutional investors may be put off by this fact due to negative bias. However, a closer look at the transaction provides sufficient reassurance.

- Low float/liquidity: IGIC’s public float amounts to approx.15.4m shares (representing 34% of the company or +$350m), while insiders such as the founding family and other affiliated investors (Oman International Development & Investment Company at ca. 21%), together with the original SPAC sponsors, own the rest.

Key risks

The company is not without risks:

- Exposure to Nat Cat, political violence, cyber, you name it.

- Too rapid expansion and acquisition of new talent.

- Underwriting cycle turn – Softening of rates as more capacity comes in from both new and established players.

- Competition – Let’s not forget that nobody wants to pay higher insurance premiums.

- Accounting fraud – E&Y at Wirecard?

My hypotheses:

(1) The market in which IGIC operates is poised to grow long-term.

(2) IGIC is a first-class operator in its niche.

(3) IGIC’s management is shareholder-friendly.

(4) IGIC is trading at a discount to its fair value (at least +15% IRR).

Whether I am right or wrong, we will certainly learn something from this case.

If you are interested in reading more about the company I recommend articles on IGIC from Chief Inspector and VIC, which also contributed to my thinking here.

Feel free to leave your comments in the below section or reach out to me via a direct message or e-mail.

Disclaimer: The material and analysis in details herein is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. All facts and statistics are from sources believed reliable, but are not guaranteed as to accuracy, completeness or timeliness in the information. The author has or had positions in the company and her positions may change over time without notice.

well written

Great write-up Mariya, enjoyed reading it.