Company name: Markel Group Inc.

ISIN: US5705351048

Ticker: NYSE: MKL

Type: Owner-Operator

Stock Price: $ 1,420 USD

Market cap: $ 19 billion

Review date: January 2024

Investment thesis

Markel Group Inc. (MKL) is a financial holding, which runs US Property & Casualty (P&C) specialty insurance operations and performs investments in a concentrated portfolio of wholly or partially owned publicly traded and private companies. The more accurate definition of the company according to its current CEO Tom Gayner is a ‘family office, which happened to be a public company’.

MKL’s business model was largely inspired by Berkshire Hathaway, whereby a float from insurance operations serves as a ‘rocket fuel’ to invest elsewhere. There are three economic engines, which are placed to work for MKL: Insurance, Investments (mainly bonds and common stock) and Markel Ventures (a collection of fully and partially owned private and public industrial and service businesses).

Summary:

− Multi-decade compounder with consistent underwriting and investment results.

− Remarkable culture embracing the ‘win-win-win’ values.

− Management of high skill and integrity.

− Fair price.

All in all, MKL emerged as an economic engine with autonomy-trust culture and diversified operations, which provide the dual benefit of generating underwriting profit and superior investment returns. Similar to some other conglomerates, the MKL’s value exceeds the sum of its parts.

Multi-decade compounder

Markel started in 1930, after two generations of family ownership, the company went public in 1986 priced at ca. $8 with market cap of ca. $30m. Over time, the company has transformed itself from a small local insurer of jitney buses to the top three largest US surplus insurance business with some international operations (see Market Segment Report - U.S. Surplus Lines, A.M. Best).

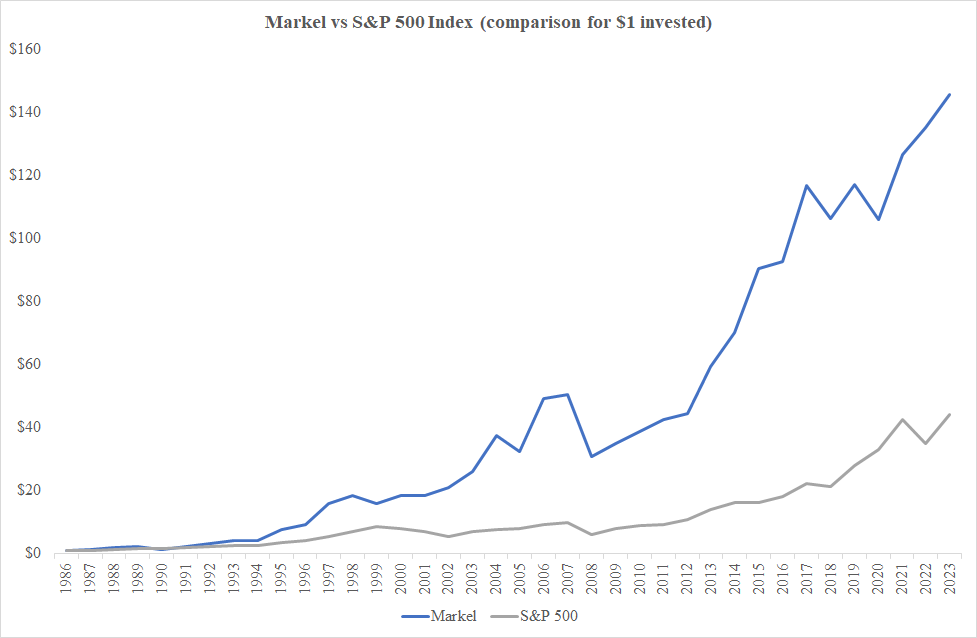

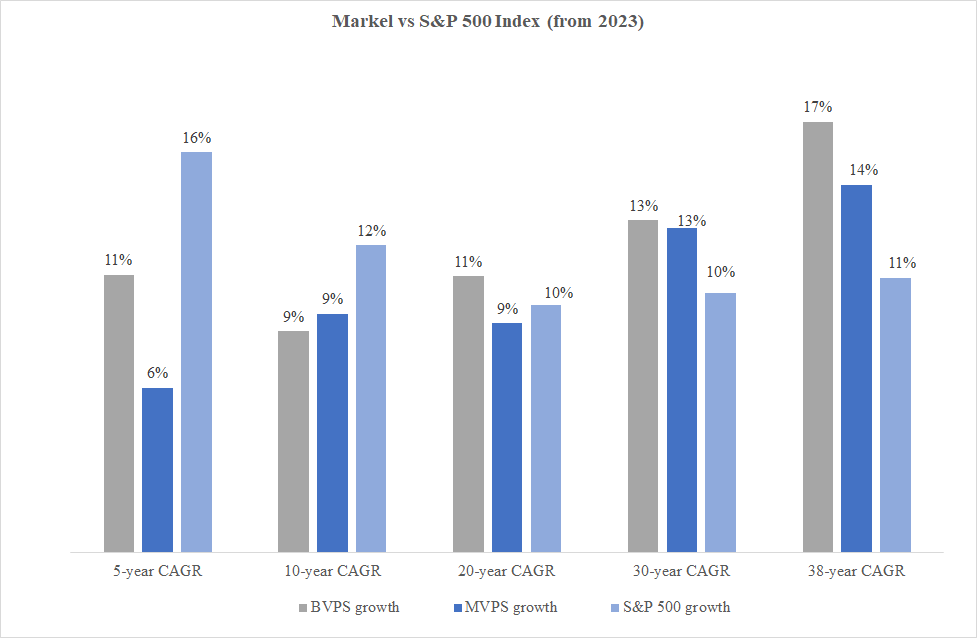

By year-end 2023, market cap reached close to $19bn, that is an impressive compound annual return of ca. 14% since the IPO. As outlined in the below, MKL managed to outperform the market by 3%-pts since inception.

In the past 5 years value creation slowed down facing challenging years of the Covid-19 pandemic, above average Nat Cat activity, financial market volatility and inadequate pricing cycle in some US Casualty lines exacerbated by rising social and economic inflation.

So what are key drivers of the MKL’s outstanding results? In my view, it is a combination of the solid insurance underwriting record and superior investment results reinforced by a unique culture. Let’s explore each source of value in more detail.

Underwriting

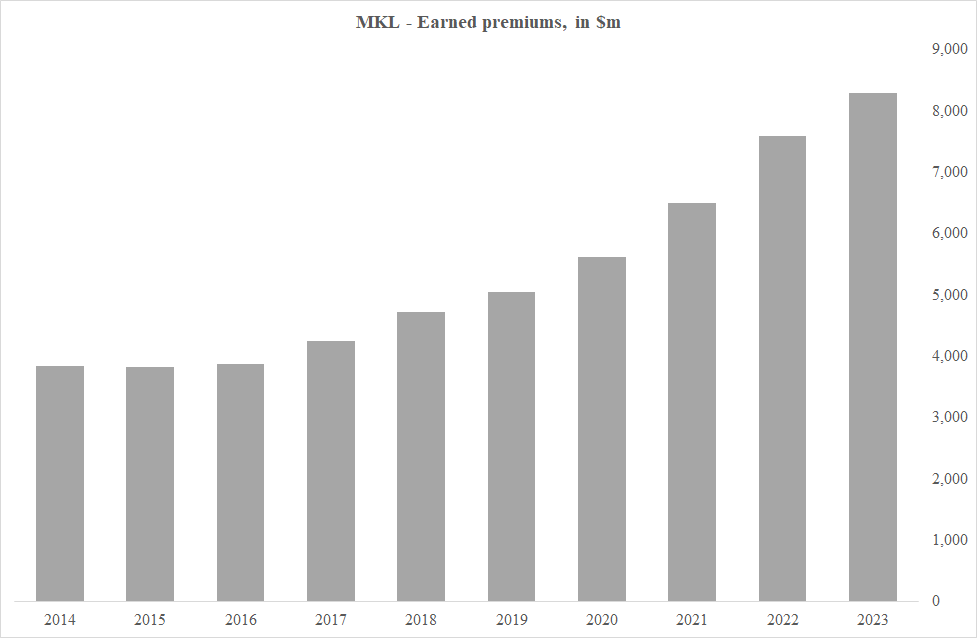

MKL operates in the US specialty market, which implies underwriting of an admitted risk and hard-to-place non-standard risk (E&S, or Excess & Surplus). The latter one is not assumed by a traditional or so called admitted market. The regulatory framework affords E&S businesses greater flexibility in setting premium rates and terms for its policies compared to the admitted market. As a result, E&S insurers like MKL compete based on value-added considerations such as expertise, availability and service rather than price only. In the past years E&S market has been growing at a high pace with CAGR of ca. 20% to ca. $86bn, which many consider as the ‘golden age’ for E&S insurers. The overall E&S industry is expected to further grow with a double-digit rate, at much higher pace of the total P&C market. The key drivers are technological advancements, economic growth and rising complexity of the current and new emerging risks.

Source: S&P Global Inc.

In 2022, MKL was the 3rd largest US specialty insurer and the 41st largest US reinsurer (as measured by premium volume by S&P Global and A.M. Best). In 2022, MKL’s combined net premiums earned amounted to $7.6bn, growing at an annualised growth rate of 13% in the past 10 years.

More than half of it is attributable to the Casualty business (mainly Professional Liability and General Liability lines), which tends to exhibit higher uncertainty towards pricing and loss reserve adequacy since claims are paid out over long period of time, i.e. multiple years. Also, this long-tail business is sensitive to macroeconomic factors like interest rates and economic inflation as well as social trends (i.e. social inflation). Despite of higher complexity, long-tail business comes with a benefit of longer periods of investment, which is supportive to the MKL’s business model.

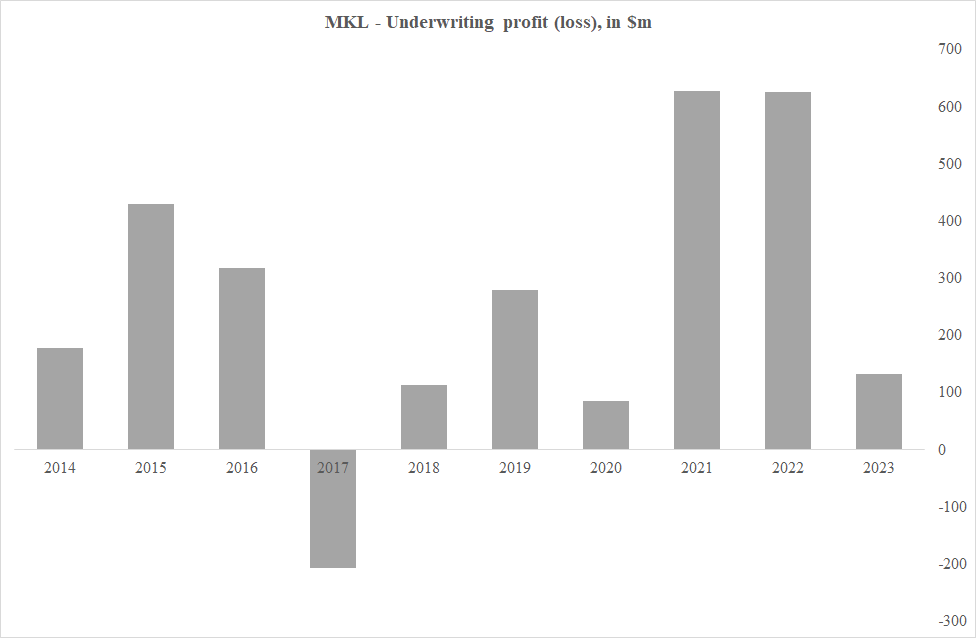

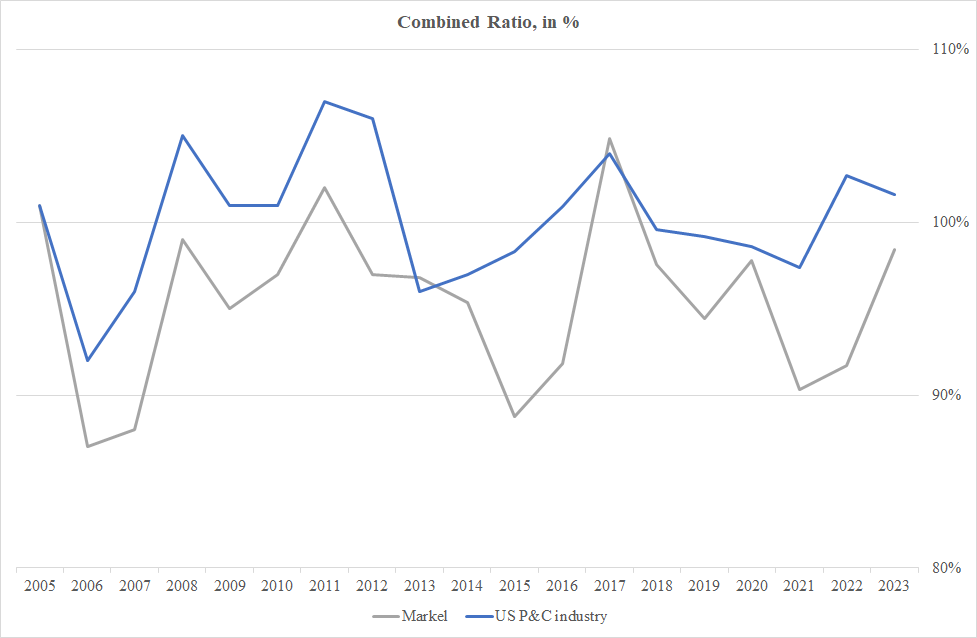

How strong is the company’s underwriting quality? Since 2013, MKL earned underwriting profit of ca. $2.6bn with an average combined ratio of ca. 95%, which is ca. 5%-pts below the US P&C industry.

In other words, MKL made 5 cents per dollar of insurance premiums after paying all operating expenses, which is on top of money it held and could invest with market-beating returns.

Since 2005, there were only three calendar years (2017, 2011 and 2005) with a combined ratio of above 100%, all driven by the above average Nat Cat events. Indeed, this is a remarkable result.

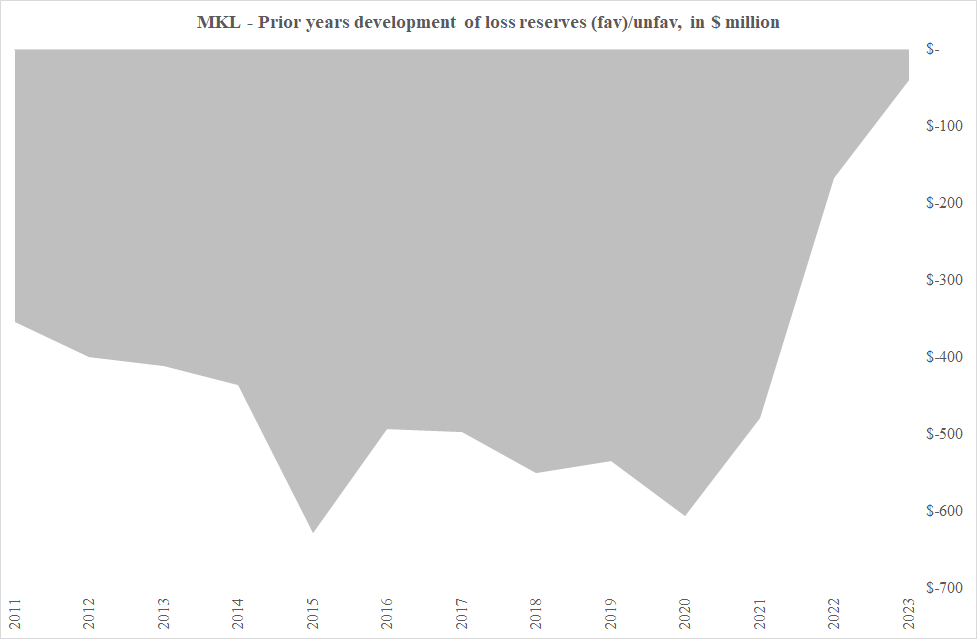

How prudent are reserving practices at MKL? The main methodologies to determine loss reserves estimate (e.g. Chain Ladder, Cape Cod, Bornhuetter-Ferguson, Benktander, etc.) are designed to avoid volatility by ‘bleeding in’ news, good or bad, over time and not at once. As a result of this, loss reserves development tends to have memory. The MKL’s prior year loss reserves development was favourable in each consecutive year over the past 10 years, with total of $4.8bn of reserve releases (ca. 10% of annual earned premiums).

To put it simply, MKL over-reserved in prior years underpinned by high prudency of loss reserving and management discipline. To note, MKL’s favourable loss reserve releases reduced in the past years, in particular applicable for accident years 2016-2019. This is mainly driven by the US Casualty industry-wide challenges from the rising social and economic inflation. The final outcome of which is yet to be seen.

Since 2015, MKL has made numerous acquisitions to establish in-house ILS services and fronting operations with aim to reduce its cost of capital. This is an asset-light business model with limited risk-bearing and marginal fee-based returns. This sub-segment of MKL insurance operations is not performing up to expectations yet given the increased Nat Cat claims load in prior years. For the purpose of the below valuation, I’ve decided to assign no value to the ILS/fronting operations given its current track record, which may be too conservative considering its growth potential in the future.

Investments

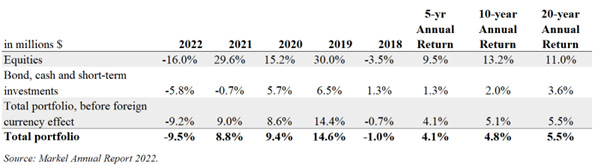

Let’s turn to the investment side of MKL business. Similar to traditional insurers, a sizeable portion of MKL’s invested assets is allocated to fixed income securities and cash primarily to match duration of MKL’s future claim obligations with duration of assets. Bonds and cash amounts roughly to two-thirds of the MKL’s total invested assets (ca. $20bn of $27bn at year-end 2022). Assets in excess of that are allocated to a concentrated portfolio of public equities and a collection of fully and partially owned private equities. However unlike for many P&C insurers, MKL has relatively high allocation of invested assets to common stock (ca. $5.7bn, or 30% of total invested assets at year-end 2022). The public equity portfolio is relatively concentrated and the top 20 positions represent close to 50% of equity portfolio as per the latest 13-F filings (incl. Berkshire Hathaway, Alphabet, Deere & Co, Amazon, Visa, Apple, Home Depot, Watsco and others). Embracing value investment philosophy, the CEO Tom Gayner steers equity investments according to the four-part test:

Invest in businesses with good returns on capital that don’t use too much debt.

Management teams should possess equal measures of talent and integrity.

Invest in businesses that can reinvest earnings at good rates of return or redistribute it.

Fair price.

Remarkably, since IPO in 1986 MKL’s equity portfolio outperformed the S&P 500 total return index. See the annual investment return breakdown by asset category in the table below.

Markel Ventures

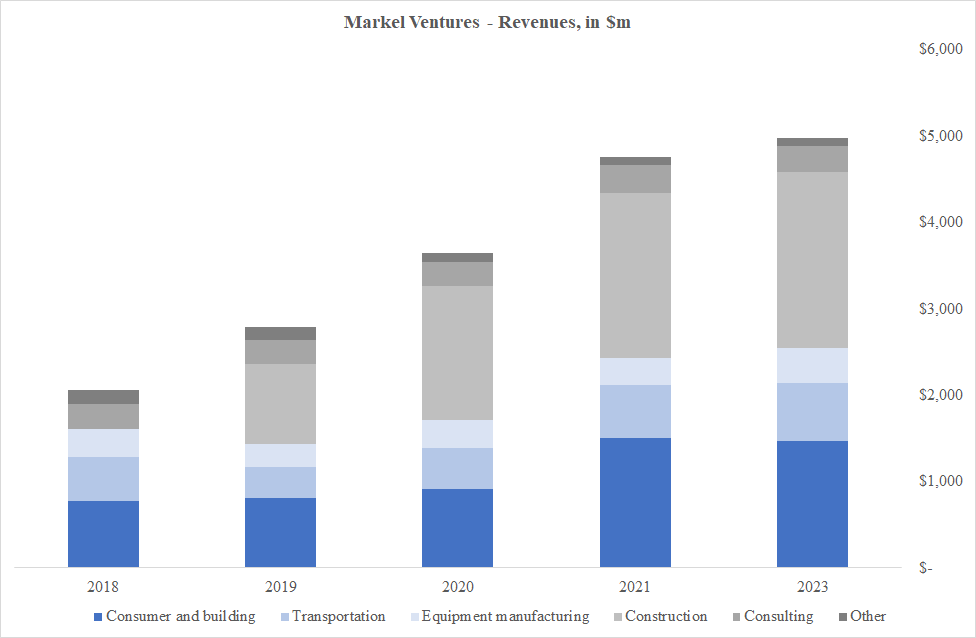

Since 2005, MKL started allocating capital to a collection of a majority owned private (mostly) and public industrial and service companies operating in various industries. Products and services include house plants (Costa Farms), building products (Lansing Building Products), crane rental service (Buckner Heavy Lift Cranes), pre-cast concrete (Metromont), concierge medical services (Partner MD), fire protection (VSC Fire & Security), IT consulting (CapTech), luxury bags (Brahmin), dredges (Ellicott Dredges), flooring (Havco), and more. Similar to Berkshire Hathaway, MKL prefers to invest in owner-founder lead operators with leading positions in niche markets and long-term orientation. It aims to offer a ‘permanent home’ to private businesses, which choose to join MKL.

Markel Ventures’ contribution to the group has drastically increased over time. The segment has become an additional source of resiliency, diversification and cash flow to MKL as a group.

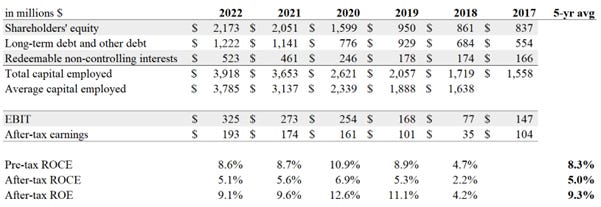

In terms of operating performance, Markel Ventures earned an operating profit of $0.3bn in 2022, which has nicely grown in the past 10 years, on average of ca. 24% per annum. Since 2017, Markel Ventures earned an average 9% on equity capital as presented in the table below.

As a side note on accounting, a portion of Markel Ventures with a non-controlling interest stake (typically 20-50% ownership) and significant control is not consolidated under US GAAP. It appears as equity method investments in ‘Other assets’ recorded at historical cost, no mark-to-market adjustments are flowing through a balance sheet. As a result, the MKL’s private equity investments seem to be understated. For example, book value of a general managing agent Hagerty acquired in 2019 amounted ca. $0.2bn, while market value of this public equity stake amounted $0.65bn at the year-end 2022. This results in off-balance sheet unrealised investment gains of ca. $0.45bn. Hence, US GAAP shareholders’ equity does not fully reflect the economic value of MKL and manual adjustments to book value may be not without a merit.

Remarkable culture

Much of the MKL’s success is attributable to the ‘win-win-win’ culture defined by the Markel Style written in 1986, whereby its customers, associates and shareholders participate in the company’s success. This culture lived in practice creates strong alignment among stakeholders.

MKL’s shareholders are considered to be business owners and partners. This shines through high-quality genuine annual letters, annual shareholder meetings as events to exchange and socialise with its business partners, and relentless focus on creating value for stakeholders.

As a multi-generational company, MKL is also consistent and long-term focused. T. Gayner jokes, if he had to choose another profession, it would be a make of the 12-year old scotch whiskey embracing his predisposition to the long-term thinking. As to common stocks, Tom Gayner follows a ‘buy and hold’ strategy not only to avoid emotional biases, but also to be more tax efficient. For instance, he started a position in Diageo more than 25 years ago and by dollar-cost-averaging it has grown to a sizable position at present. There are rare cases when major changes in the equity portfolio occur like the net sales of $1.2bn listed equities in 2020 at the beginning of the Covid-19 pandemic to preserve MKL’s balance sheet as a management’s response to uncertainty of the potential pandemic related claims. Also, long-term thinking is embedded in Markel Venture businesses, which serves as a ‘permanent home’ for many private, often family-lead companies.

Also as an incrementalist, Tom Gayner aspires to be directionally right than accurately wrong. In his daily life he follows the ‘crawl, walk, run’ principles, whereby trying something in small measures and doing more of it, if it works well.

Hands-off approach with decentralised operations in Markel Ventures allows local management teams to run operations independently and reduces management efforts at the holding level. MKL embraces the autonomy-trust based culture with accountability being more important than scale. As an example, when MKL acquired a bakery equipment manufacturer AMF in 2005, the original CEO remained in charge for at least the next 12 years.

As to another great aspect of the MKL’s culture, Tom Gayner emphasizes making mistakes and more importantly learning from them. He states “good judgement comes from experience, which comes from bad judgement”. As humble person, he admitted to a painful omission mistake of not buying a Berkshire Hathaway stock soon enough he learned about the company in 1984 (only started buying in 1990). It is a rare and valuable quality of management to publicly admit mistakes and allows transparency around it.

Management of high skill and integrity

The most valuable Markel’s intangible asset, which is not visible on the balance sheet and is not fully reflected in the above valuation, resides with its spectacular management team.

The founder Markel family managed to grow the business and passed on core values through multiple generations, which remain great contributors to the Markel’s success. The 3rd generation of the founder family members, namely Anthony Markel and Steve Markel, serve as non-executive directors. The family demonstrated strong ability to select skilled managers with equal merit of talent and integrity.

One of the unmatched assets in the company is Tom Gayner, a well-known value investor with a solid track record of market-beating returns. He joined MKL in 1990 and has overseen the investment portfolio since then. In 2016, he stepped in the co-CEO role and the sole CEO as of 2023. More recently, T. Gayner became a non-executive director of Coca-Cola.

Moving on to the talent side, the MKL management team exercises a strong discipline in capital allocation, which over the past three decades allowed to compound shareholders’ returns at an incredible average rate of ca. 15% per annum, well above ca. 10% what S&P 500 delivered in the same timeframe.

MKL follows a proven capital allocation strategy, which is applicable to all investments:

1. Invest in existing businesses.

2. Acquire new businesses.

3. Acquire publicly traded companies.

4. Repurchase own shares, if a price is below reasonable intrinsic value estimate.

MKL managed to reinvest earnings into profitable insurance operations, private and public companies through Markel Ventures and Investments, while also returning capital back to its shareholders in a form of share buy-backs. The latter action is justified by a sizable discount to the intrinsic value and brings a value-added benefit of increased ownership to shareholders.

Another attribute of the management’s discipline is no use of own stock to acquire new companies, whereas most deal considerations were paid in cash. There were only few exceptions, when MKL issued own stock to finance major acquisitions, e.g. Alterra in 2013 and Terra Nova (renamed to Markel International) in 2000.

Since 1986, MKL’s paid no dividends, whereby embracing its ability to reinvest retained earnings back into business at attractive returns. Thanks to management’s discipline to walk away from unprofitable business and to talent in finding new opportunities, MKL managed to transform its insurance float from a liability to an economic asset. I am aware of only few examples of holding companies, where insurance float was turned to a durable asset, namely Berkshire Hathaway, Alleghany and Fairfax Financial.

As to incentives and compensation, the MKL management remuneration is based on the long-term view, i.e. 5-year growth book value growth per share and growth in total shareholders’ return. The executive management and directors own close to 2% of a company as a group[1]. Although it is a relatively small figure, each director owns some MKL shares, while for few officers and directors MKL stock represents a sizeable amount of their private net worth. In addition, there are no excessive compensation packages. The MKL’s directors and officers compensation is relatively modest in the context of US corporate world. In 2022, the highest paid employee earned below $5m (T. Gayner CEO).

Most recently, we can observe numerous open market stock purchases by senior management, inc. T. Gayner and some non-executive directors (e.g. L. Cunningham, L. Puckett, G. Harris). In light of the intensified MKL share buy-back activity since 2017, this is an encouraging sign that the management truly believes that the business group is currently undervalued.

Fair price

My fair value estimate of MKL business following three methods (i) Sum of its parts, (ii) GAAP-adjusted financials and (iii) simple Price to Book (P/B) ranges between $1,400 and $2,400 and on average amounts to close $1,850 per share. Personally, I think the fair value is closer to the upper end of the range given conservatism of my underlying assumptions. Importantly, Markel is a collection of business generating cash flows, which grow over time. Hence, the above figure is a point-in-time value, which should be revisited as the Markel business continues to evolve. If interested to learn more details on my valuation assumptions and approach, please reach out to me in the comment section or email.

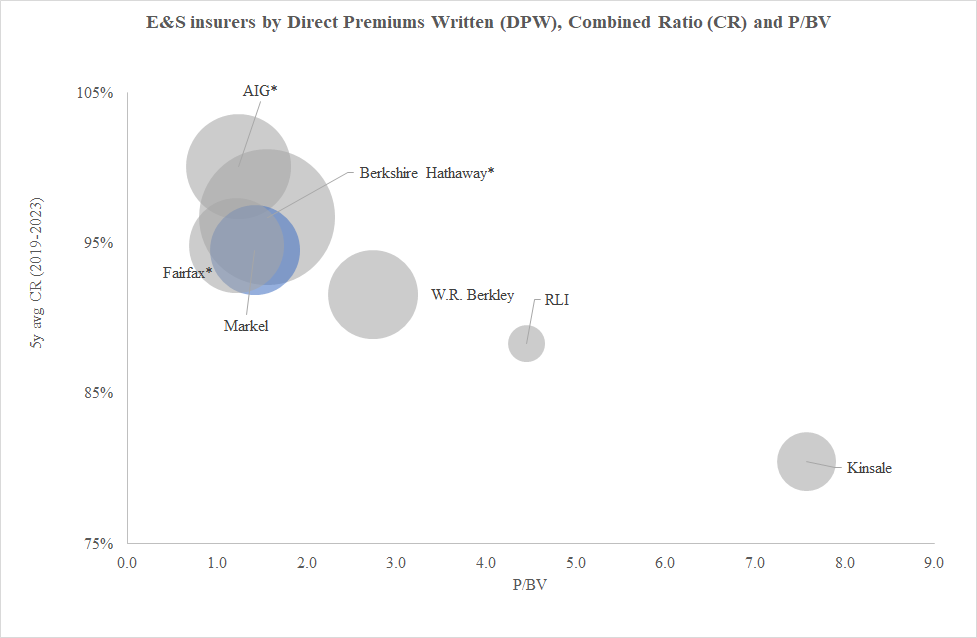

Compared to its core peers in the E&S market, MKL is valued ca. 1.4x and MCAP/EBT at ca. 7.0x., which is close to some well known conglomerate-like businesses, incl. Berkshire Hathaway and Fairfax Financial. In the past years, the MKL market price lagged behind the company’s BV growth in part due to some management missteps in pricing of some US Casualty lines of business, underperformance of CatCo and Nephila operations and the recent scandal related to write-downs on fraudulent letters of credit tied to Vestoo.

Horizontal axis: P/BV based on May 10, 2024 (Source: Tikr.com). Vertical axis: 5y average combined ratio. Bubble size: DPW (Source: S&P Global).

In my view MKL is well positioned to withstand the temporary setbacks and steer its direction towards sustainable and profitable long-term growth. What gives me so much confidence? Well, the insurance cycles happens to turn. Sooner or later the US Casualty business will be re-priced by the industry and MKL in particular. Also, it is about MKL’s remarkable culture and structural advantage of being a multi-decade capital allocator with embedded diversity of cashflow streams. Plus, so far MKL managed to earn attractive long-term returns from all sources combined: Underwriting, Investments and Markel Ventures - de-facto getting ‘cost-free’ insurance float and earning premium on other operations. If the market does not get the beat, I am happy to see more share buy backs coming our way as long as the business continues to be undervalued.

Let’s revert

Markel is a strong business that has been set up to sustain distressed periods, but it’s not without its risks. So what is the ‘bear case’ for the company?

Competition: MKL’s insurance operations may fail to grow profitably due to strong competitive pressures in the insurance specialty industry

Low frequency and high severity insurance events: For example, severe natural catastrophe events and any new unknown risks, may impair MKL’s operations

Operating risk: To some extent MKL is dependent on few skilled individuals like Tom Gayner who help to preserve the company’s culture and promote business resilience

M&A: MKL may become an acquisition target by some other major conglomerates, e.g. Berkshire Hathaway

Summary

Markel is a company with a remarkable culture and solid collection of cash-generating businesses, which earnings power has been consistently growing over the past decades. The company’s long history of well-deserved success and still relatively high potential for growth given its current size makes it a solid business case. If I was applying earlier mentioned capital allocation principles myself, Markel is a business with (i) good returns on capital without too much leverage, (ii) management with equal measures of talent and integrity, (iii) growth prospects and (ix) reasonable valuations. Lately, the company faced some headwinds in underwriting and made few missteps publicly acknowledged by the leadership. However, the resilience of its business model and genuine culture will bring the company forward and create value for long-term investors. Isn’t a “wonderful business at a fair price”?

Disclaimer: The material and analysis in details herein is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. All facts and statistics are from sources believed reliable, but are not guaranteed as to accuracy, completeness or timeliness in the information. The author has or had positions in the company and her positions may change over time without notice.