Accelerant

Tech-led specialty platform matching underwriting talent with long-term capital - mini-Lloyd's of London 2.0?

Editor’s note (Jan 12, 2026): Since publishing this article, further discussions with insurers and reinsurers in the E&S market have led me to reassess my conviction. While the business model remains appealing, I have ongoing reservations around execution and alignment of interests. I currently put this case into a “too hard” pile. Please read the original article with this context in mind and conduct your own independent research. This is not investment advice.

Intro

The global SME specialty risk market remains underserved since large insurers avoid the high volume of small, low-premium policies. At the same time, rapid advances in technology, in part due to improvements in AI, are beginning to reshape how risk is underwritten and distributed. When these efficiencies are paired with a scalable, data-driven, capital-light model built on recurring fee-based revenues that can hold up even in downcycles, the result is intriguing. The company I examine here is still early in its journey, with limited history and real downside risk. Yet it holds the potential to become a compelling force in reshaping the specialty insurance industry for the better.

Company name: Accelerant Holdings

ISIN: KYG008941083

Ticker: NYSE: ARX

Type: Owner-Operator

Stock Price: $ 20 USD

Market cap: $ 4.4 billion

Review date: Sept 2025

Investment thesis

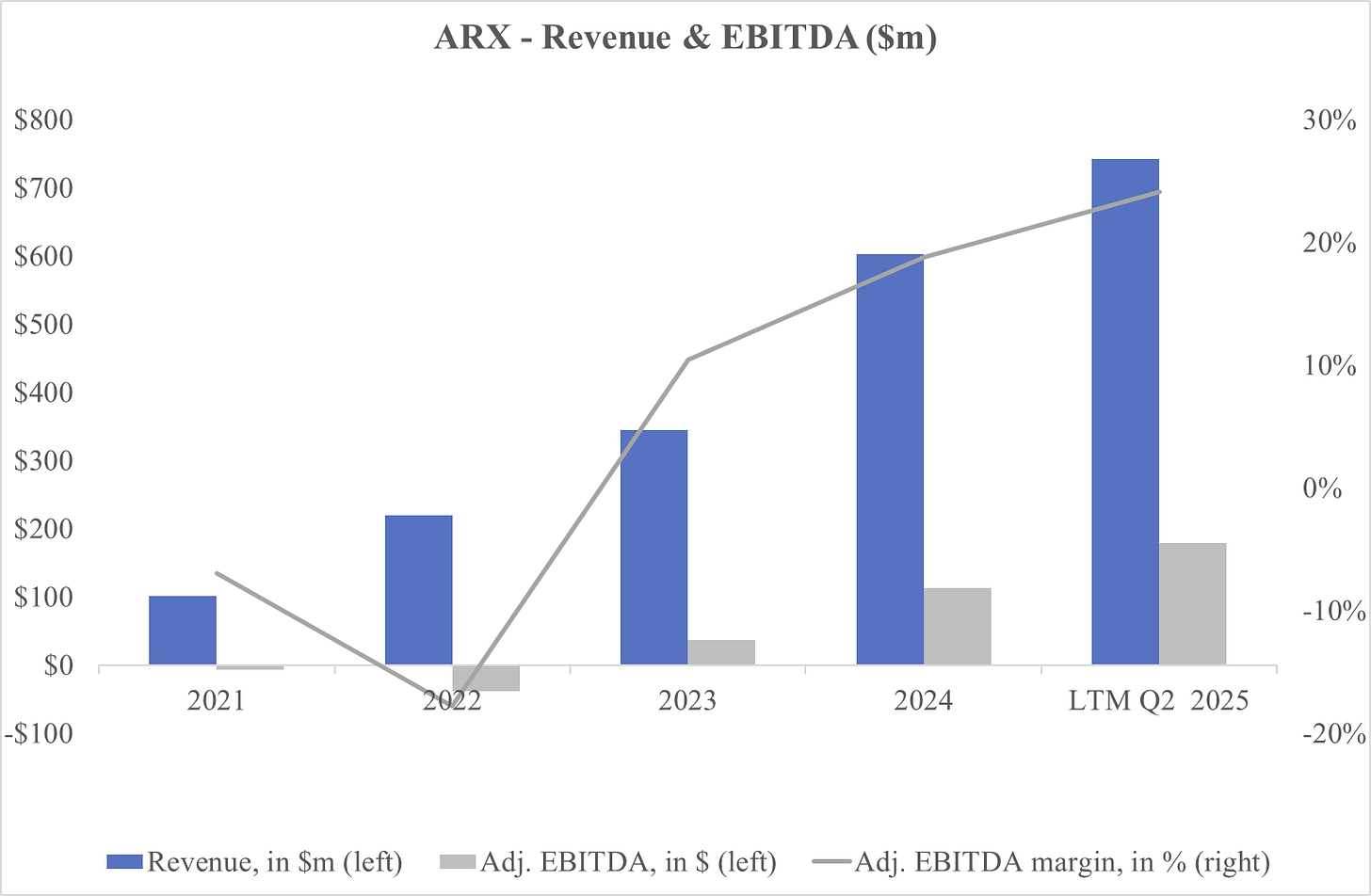

Accelerant Holdings (ARX) is a founder-led, tech-driven specialty insurance platform that connects carefully selected program underwriters with long-term risk capital providers such as insurers, reinsurers, and institutional investors. By combining modern technology, niche underwriting expertise, and trust-based relationships, ARX has built a risk exchange designed to make specialty risk transfer more efficient. In just a few years, the platform has scaled to ~$3.8bn of written premium and reached profitability in 2024, addressing a large and underserved segment of the P&C market: SME specialty risks. Following its IPO earlier this year, however, shares fell ~30%, erasing the debut premium and leaving the stock at ~14.3x forward EV/EBITDA and ~12x P/B. Scepticism still dominates, but if management executes and the business shifts toward more independent cash-generative growth, ARX could deliver IRRs north of 20% by 2030.

Background

ARX was founded in 2018 in the Cayman Islands by three industry veterans Jeff Radke (CEO), Chris Lee-Smith (Head of Distribution), and Frank O’Neill (CUO) after decades at firms like Argo, Swiss Re, Guy Carpenter, WTW, and Aon. Backed by private equity group Altamont Capital (still holding a majority stake), the trio set out to fix what they knew firsthand: The specialty insurance value chain was bloated, fragmented, and riddled with data asymmetry and cost inefficiencies.

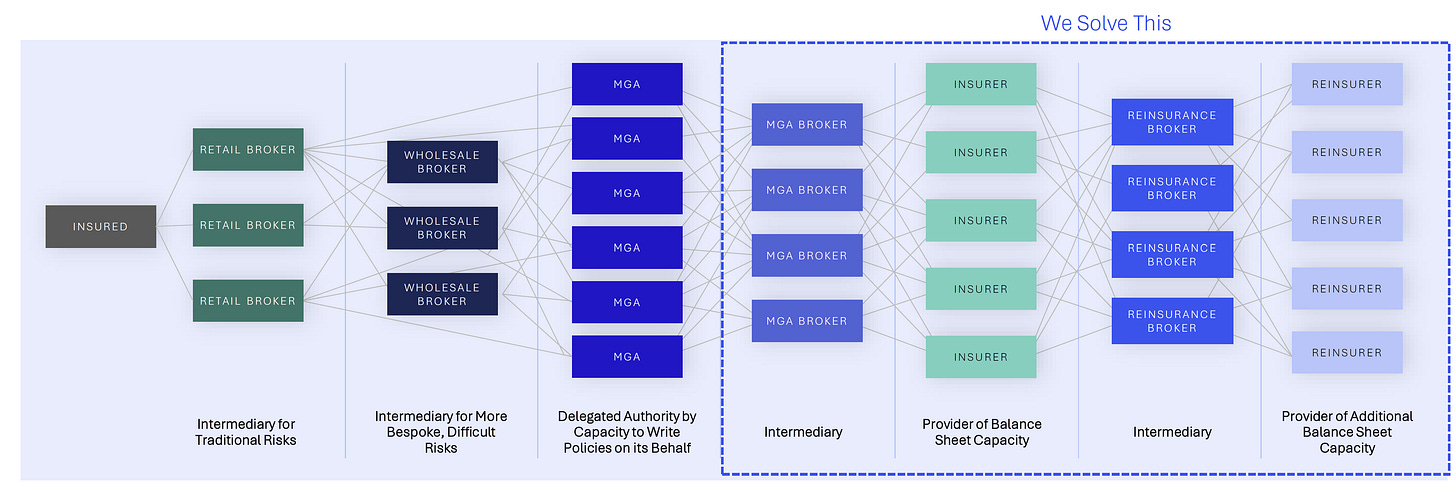

The insurance value chain is rarely straightforward. A single policy can pass through multiple hands before the risk finally settles on the balance sheet of an insurer or more often a reinsurer. In specialty lines, the path is even more complex: Risk often winds its way through retail brokers, wholesalers, MGAs, and reinsurance brokers. Each intermediary can add genuine value, given the expertise required to place nuanced and unusual risks. But this layering also creates friction — extra fees, loss of data, slower processes, and diluted transparency. To make matters worse, many traditional players still operate on outdated legacy systems, leading to poor data quality, inaccurate risk pricing, and an inability to serve certain niches effectively.

Source: Accelerant

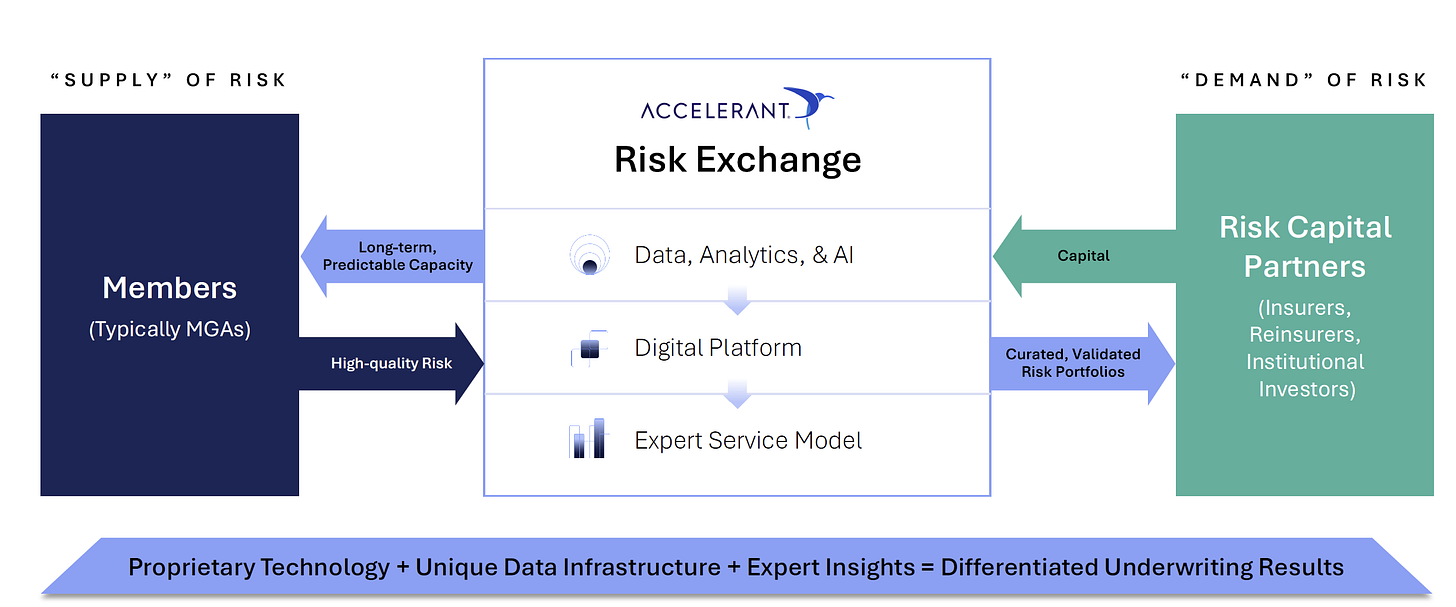

ARX’s answer to this problem is a technology-driven platform ‘Exchange Risk’ that matches specialist underwriters (or so-called Managing General Agents (MGAs)/Managing General Underwriter (MGUs)) with long-term capital providers. The model is designed to align incentives, lower costs, and provide better data and smarter insights.

It’s meant to be a “win-win-win”: (i) ‘supply side’: MGAs, who perform underwriting on behalf of an (re-)insurer, get analytics, distribution management, operational and regulatory support, and most importantly, reliable long-term underwriting capacity; (ii) ‘demand side’: insurers and reinsurers gain access to a hard-to-access and high-quality balanced portfolios to bring more diversification and profitability to their book; (iii) end policyholders benefit from faster, broader and simpler risk coverage.

Source: Accelerant

In many ways, ARX resembles a modern, scaled-down Lloyd’s of London. Like Lloyd’s, it is less an insurance company than a marketplace, connecting specialist underwriters with capital providers. The difference, of course, is scale and maturity: Lloyd’s carries centuries of tradition and roughly $70bn of premiums, while ARX is still young and far smaller. Its technology may help reduce bureaucracy and provide cleaner data, but it has yet to prove that this leaner model can deliver the same depth of trust and staying power that makes Lloyd’s unique.

With that ambitious idea, ARX set out to address genuine industry pain points, and growth came quickly. The company launched in Europe in 2018, added its first insurance carrier a year later, and by 2020 had entered the U.S. market with both admitted and Excess & Surplus (E&S) carriers, each carrying an ‘A-’ (Excellent) rating from A.M. Best.

In 2021, ARX added another layer by creating Mission Underwriters, an in-house incubator that gives entrepreneurial underwriters the tools and infrastructure to launch their own MGAs. It was a natural extension of the platform — helping talented people focus on underwriting while ARX takes care of the heavy lifting.

A year later came Flywheel Re, a Bermuda-based sidecar seeded with roughly $175m of capital from four institutional investors on a three-year term. When that facility expired in mid-2025, ARX renewed and upsized capacity with new partners — which management has indicated include QBE and Tokio Marine — extending the arrangement through June 2028. What makes Flywheel Re distinctive is its design. Rather than being confined to high-volatility Nat Cat exposures, as most sidecars are, Flywheel Re reinsures ARX’s own carriers on a quota share basis across a diversified specialty portfolio. The result is access to capital that combines diversification, predictability, and stability bringing balance to the ‘demand side’ of the ARX platform, and fair access to balanced portfolio of specialty risks for more sophisticated capital providers chasing uncorrelated returns.

One of the key differentiators of ARX is its technology backbone. Unlike many incumbents weighed down by legacy IT, ARX runs on a proprietary system built from scratch. Management notes that nearly a third of its ~475 employees are engineers, data scientists, and product specialists focused on building a tech-enabled marketplace. Data flows directly from MGAs, TPAs, and independent third-party sources, ranging from weather and climate data to financial and demographic inputs. This information is cleaned, structured into a single dataset, and then made available as actionable insights to all members on the platform. By March 2025, ARX had ingested over 79 million rows of data across 21,000 unique attributes, adding close to 9 million new rows each month. The benefits are clear: Unusual transparency, real-time portfolio monitoring, smarter pricing, lower distribution costs, and ultimately better loss ratios. Management has also begun showcasing AI use cases, such as (i) predicting claims with recovery potential (boosting gross loss ratios by ~1%), and (ii) risk indexing that improves loss distribution and price-risk matching (adding up to ~5% improvement).

To sum up, ARX has scaled by growing both sides of its marketplace — incubating and attracting MGAs with solid track records, while also drawing in capital from carriers, reinsurers, and institutional investors. This two-sided growth has fueled rapid expansion and challenged the traditional insurance model by widening access to capital and enabling underwriters to deploy it more efficiently.

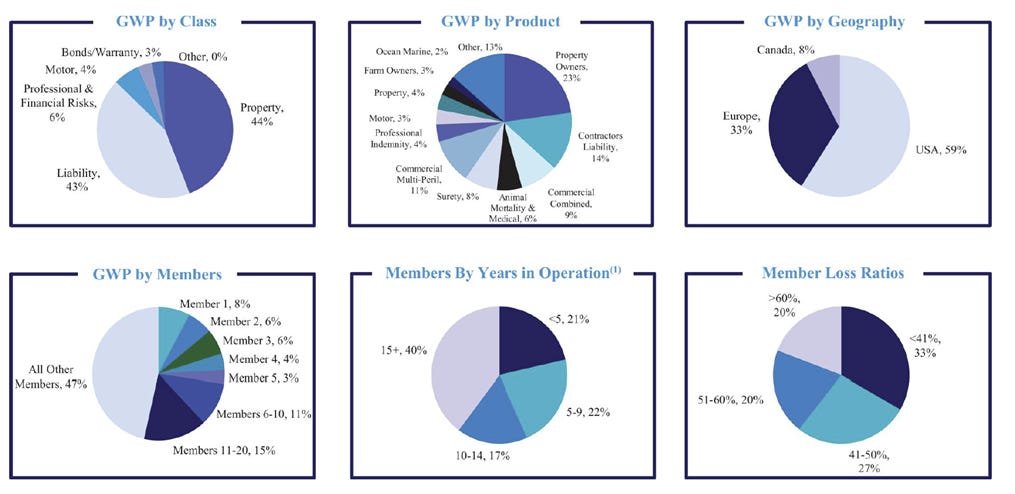

Today the platform spans 22 countries, trading $3.8bn in premiums across 500 products, with 248 MGA members and 98 risk partners. On July 24, 2025, ARX capped its journey with an IPO on the NYSE marking both a milestone and the beginning of a new phase of its growth story.

Industry backdrop

ARX is tapping into a large and growing addressable market: Small and medium-sized businesses in commercial P&C biased towards a low-volatility and low-frequency risk profile. The SME commercial market is yet highly fragmented and underserved by traditional carriers. Management estimates the SME P&C risk pool at about $117bn in 2022, while the broader specialty P&C market across the US, Europe, Australia, and Canada is closer to $250bn.

Since ARX’s platform is centred around serving MGAs, let’s spend some time to better understand who they are and why they became so embedded into the insurance value chain over the past years.

What is an MGA?

An MGA is a specialized insurance intermediary with delegated authority from an insurer. Unlike a broker, it can underwrite policies, price risk, and sometimes handle claims without taking the risk on its own balance sheet. MGAs typically design niche “programs” (e.g. for contractors, cyber, or liability lines) and scale them into portfolios of similar risks that are attractive to insurers and reinsurers. This focus and scalability explain why MGAs have become such powerful growth engines in distribution.

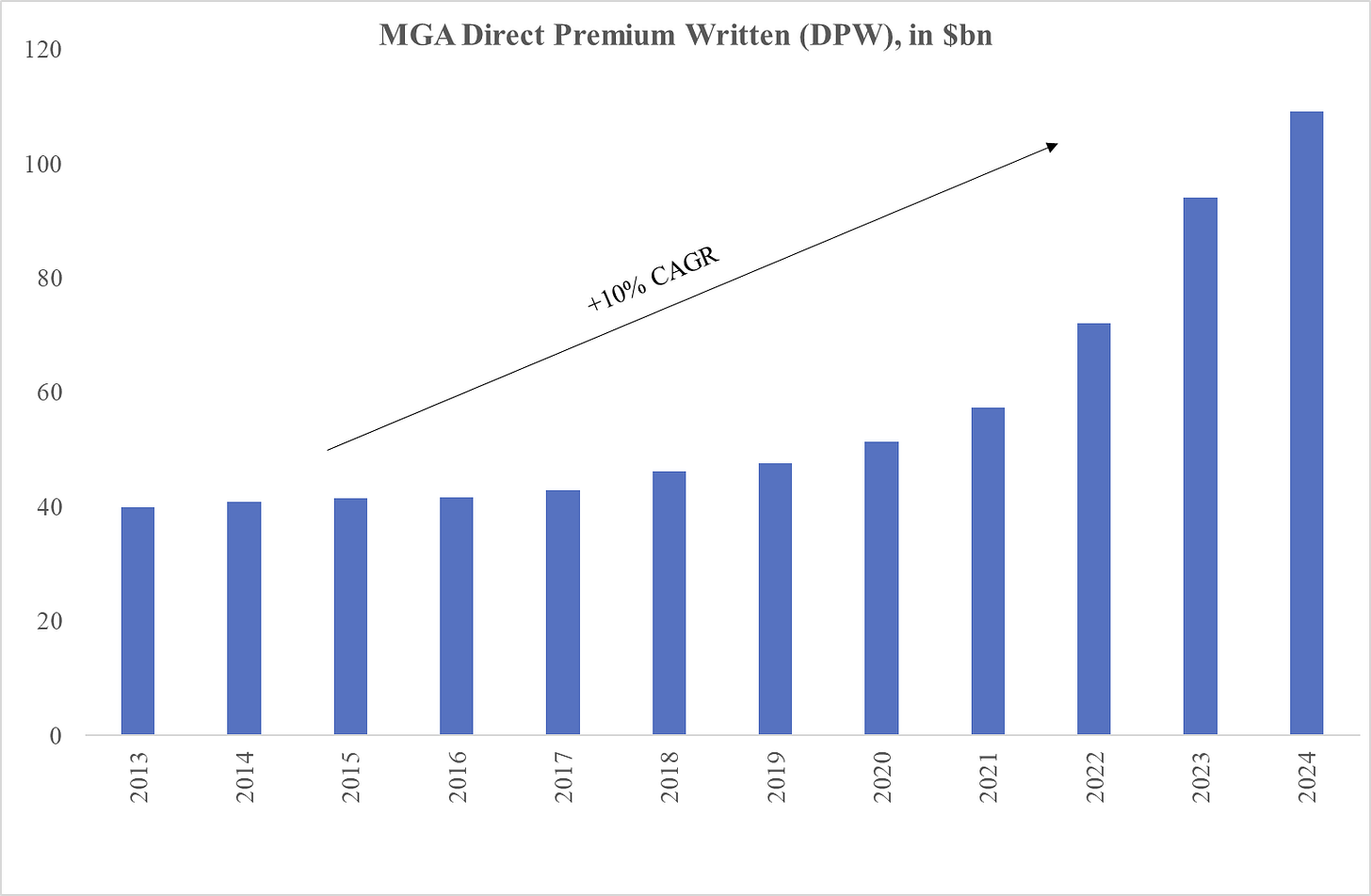

As P&C insurance industry moves towards higher specialisation and cost efficiency, the MGA market size reached nearly $100bn in 2024 according to Gallagher Re.

Source: Aon.

So why are MGAs thriving today?

There may be plenty of good reasons, but the ones that stand out to me are the following:

Reinsurers chasing profitable growth. Traditional insurers have grown too large and diversified, while reinsurers were left with capital-heavy tail risks, turning into kind of a ‘shock absorbers’. To rebalance portfolios and access steadier, low-severity specialty risks, reinsurers are increasingly turning to MGAs and fronting carriers.

Technology tailwinds. Tech-driven advancements, data analytics, and AI allow MGAs to run lean operations and design innovative products incumbents avoided because of high servicing costs. Backed by private equity, many MGAs scaled rapidly into niches where legacy carriers were too slow to compete.

Magnet for talent. The combination of equity ownership, higher compensation, and entrepreneurial freedom has pulled underwriting talent away from traditional monolith balance sheet carriers into MGAs.

Shift toward bespoke cover. The share of the E&S market in overall P&C has tripled from ~4% in 2001 to 12% in 2023 according to AM Best, reflecting growing demand for tailored, non-standard solutions — an MGA sweet spot.

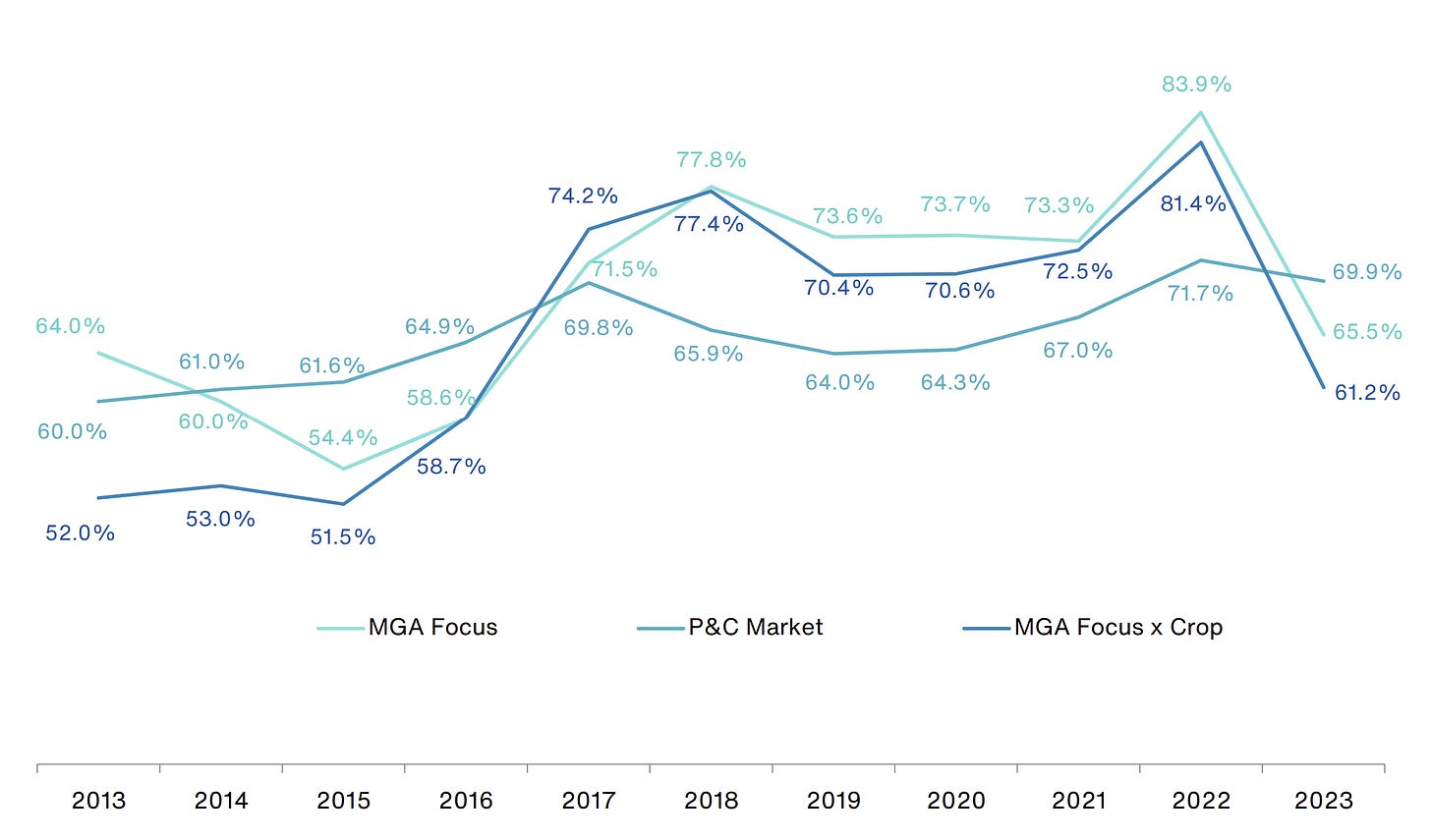

Operational efficiency. Roughly 30% of each premium dollar in insurance still goes to expenses. MGAs (with some notable exceptions!) have proven they can deliver lower loss ratios and run more cost-efficiently, a critical advantage as the insurance cycle begins to soften.

Source: Historical MGA loss ratios, Aon.

Alternative capital. Pension funds and asset managers increasingly seek returns uncorrelated with the broader financial markets. MGAs, often paired with fronting carriers, now offer them access to diversified specialty risk (beyond narrow Nat Cat exposure) on a multi-year basis.

One may argue that this shift to MGAs is temporary, but to me it appears to be rather structural. Heightened demand for specialty insurance, growing reliance on innovation and efficiency, and the influx of both reinsurer and institutional capital all point in one direction: MGAs are no longer a niche corner of insurance but an important growth engine.

Business model

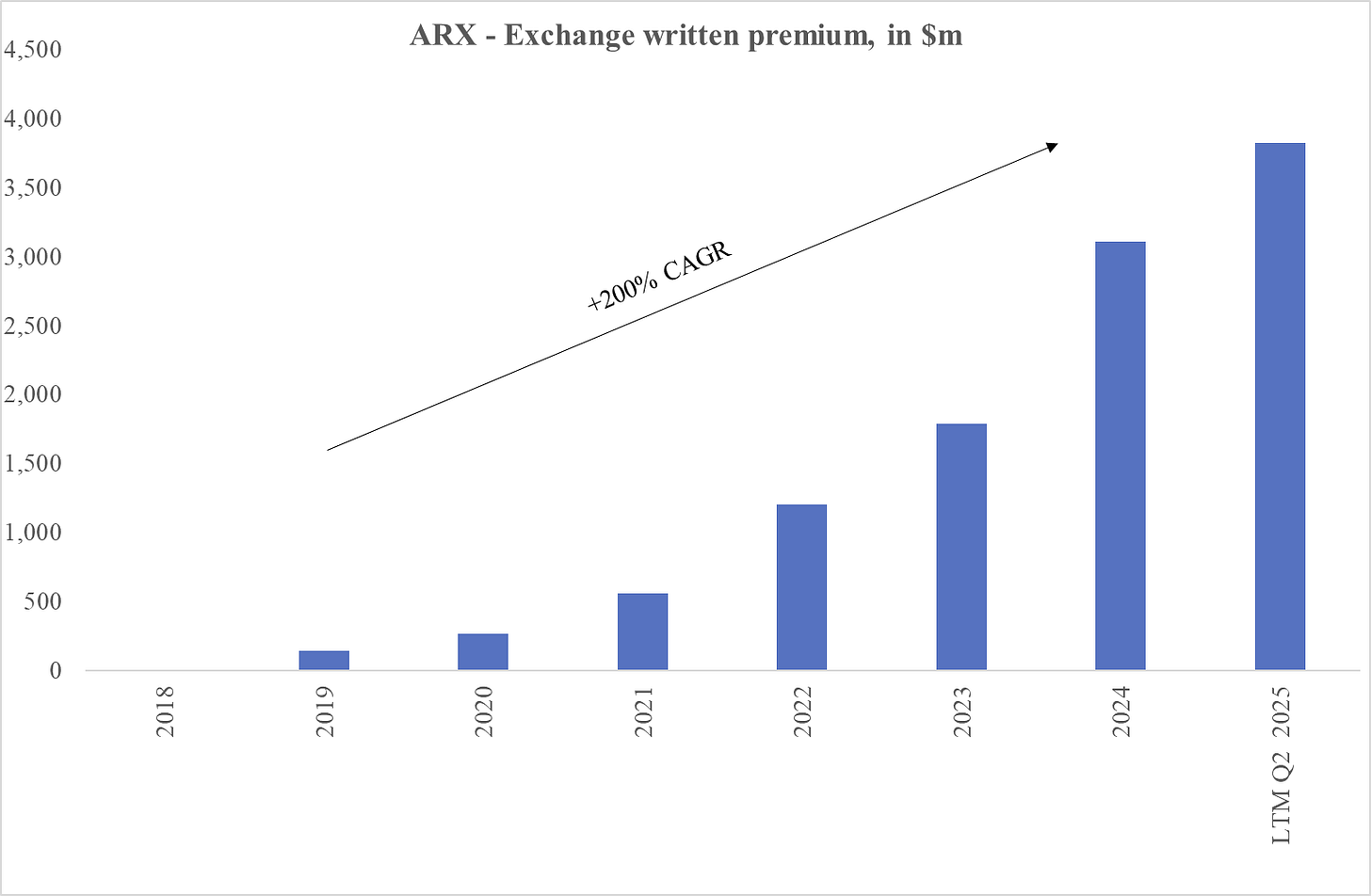

At its core, ARX is a platform for seamless risk transfer. Since inception in 2018, ARX exchange written premium have grown more than 200% per year, reaching $3.8bn in the twelve months to June 2025.

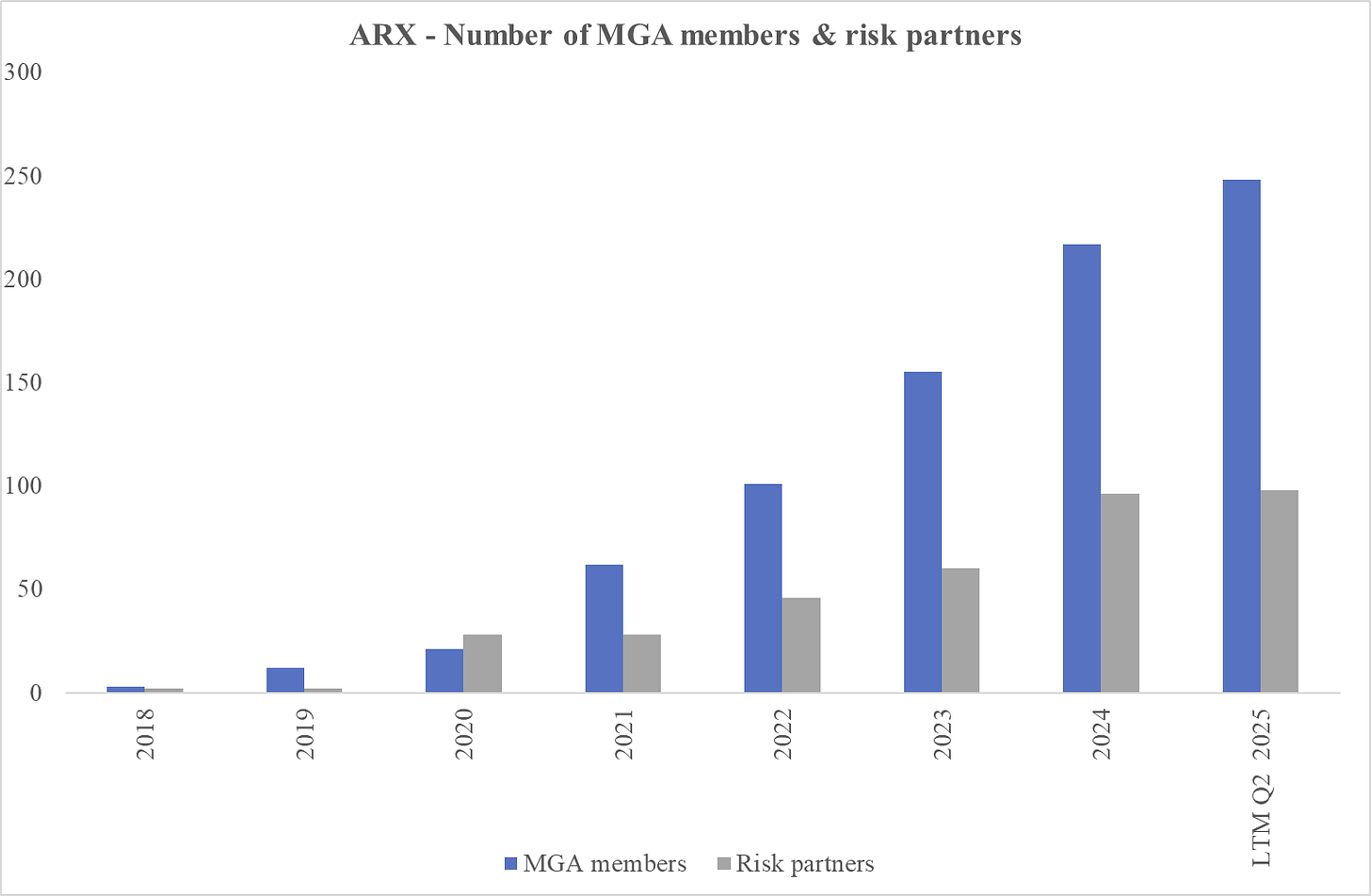

The rapid growth was driven in part due to growing amount of MGAs or so called ‘members’ joining the platform, amounted to 248 in June 2025.

A typical MGA or a ‘member’ who joins the platform is small but sharp: $10–40m of premiums, 15–30 people, and an average of 15 years’ underwriting experience. They focus on niches, incl. property owners, contractors liability, surety, commercial multi-peril and other. ARX selects its MGAs through an apparently strict due diligence process MGA with the below set of criteria:

3-to-5 year underwriting track record

Predominantly commercial, low-limit SME risk focus

Underwriter-led culture with focus on profitable business

Premium volume of $3m to $100m

Robust data capture and ability to share it within the platform

Long-term commitment

Source: Accelerant (S-1 filing).

Many MGA members remain affiliated with ARX, though the mix is shifting toward more independents as the platform scales. Some are incubated as “mission members” (31 of 248), starting fresh MGAs under ARX’s umbrella. Others are “owned members” (16 of 248), where ARX holds minority stakes to align incentives and share in earnings. Together, they contributed ~$1.1bn or 30% of premiums over the last twelve months.

ARX’s success and the benefits of scale ultimately hinge on its ability to attract high-quality MGAs that can deliver consistently strong underwriting results to capital providers. Management highlights that MGA members post gross loss ratios in the mid-50s, well below the industry average of 60–70%. It’s an encouraging figure, but one that deserves scrutiny: How much of this performance reflects current-year underwriting discipline versus prior-year reserve releases, whether favorable or unfavorable?

Turning to the risk capital providers, which amounted to 98 in June 2025. The platform now counts 79 reinsurers, 13 insurers, and 4 institutional investors who participate through Flywheel Re, a Bermuda sidecar. The mix of capital, i.e. traditional and alternative, brings stability to the ARX business flow, but at the same time may cause competitive pressure among capacity providers which may somewhat strain their relationships with traditional reinsurers.

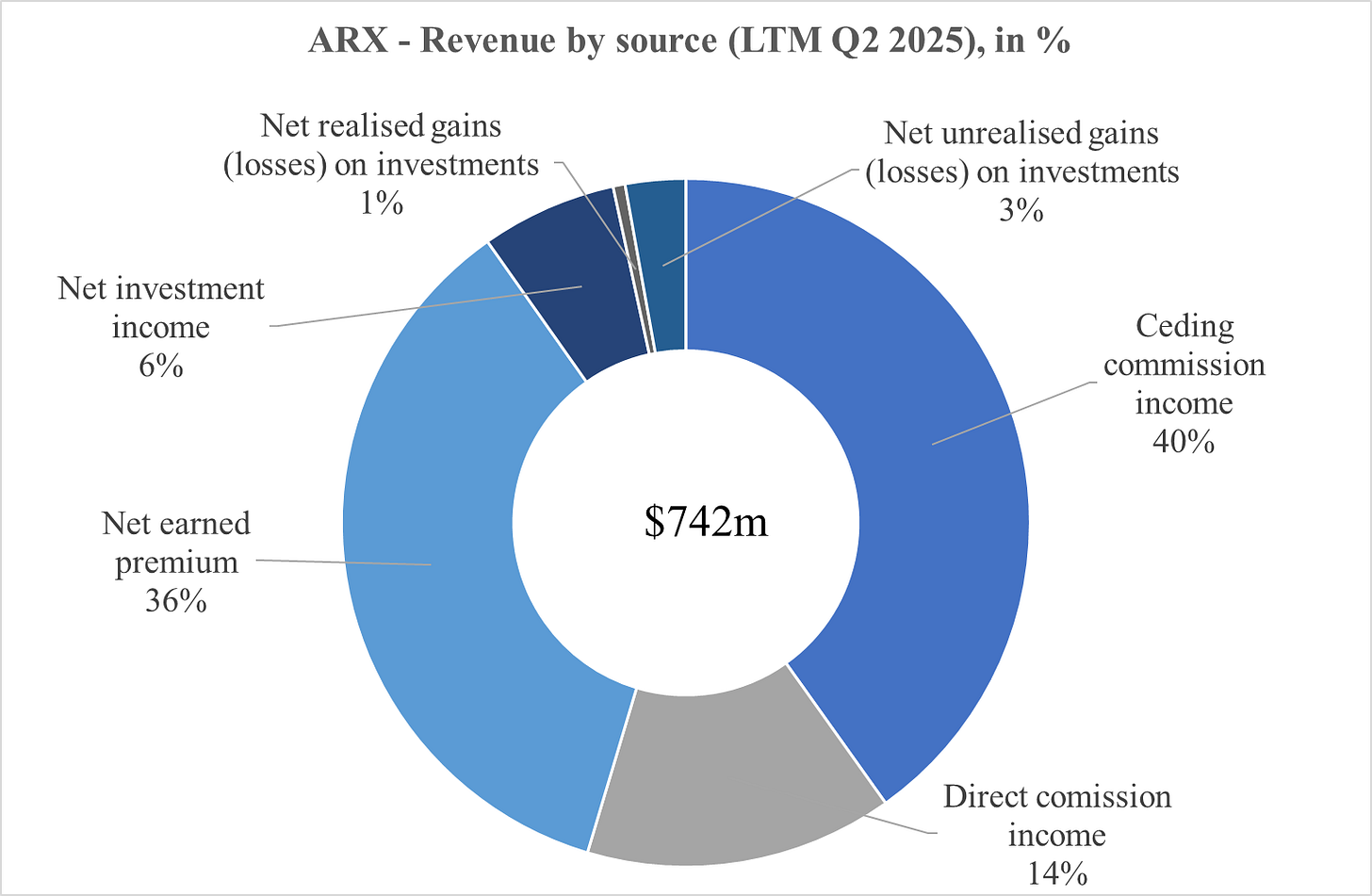

As a platform built around underwriting, ARX has developed multiple revenue streams, of which key elements are:

Risk Exchange: A fee on exchange premiums (approx. 7-8%), paid by capital providers for sourcing, managing, and monitoring portfolios.

MGA Operations: Commissions on exchange premium from fully or partially owned MGAs (approx. 18%).

Underwriting: Ceding commissions from reinsurers plus underwriting results on the small share of risk retained by ARX’s own carriers (approx. 3% on gross earned premium). Simply put, here ARX acts as a hybrid fronting carrier.

Since launch in 2018, revenue has compounded at more than 55% per year, reaching about $742m in the twelve months to Q2 2025.

The mix is outlined above: Roughly 40% from ceding commissions, 35% from net earned premiums on retained risk, 15% from direct MGA commissions, and the remaining 10% from investment income and gains. Adjusted EBITDA stands at $179m with operating margins approaching 20%, gradually expanding as the platform scaled.

As to now, the in-house insurance operations sit at the heart of the platform. Strong results here are essential: Underperformance not only pressures ARX’s own P&L but could also discourage external risk capital providers from joining. So it’s worth pausing to examine how good ARX’s underwriting really is.

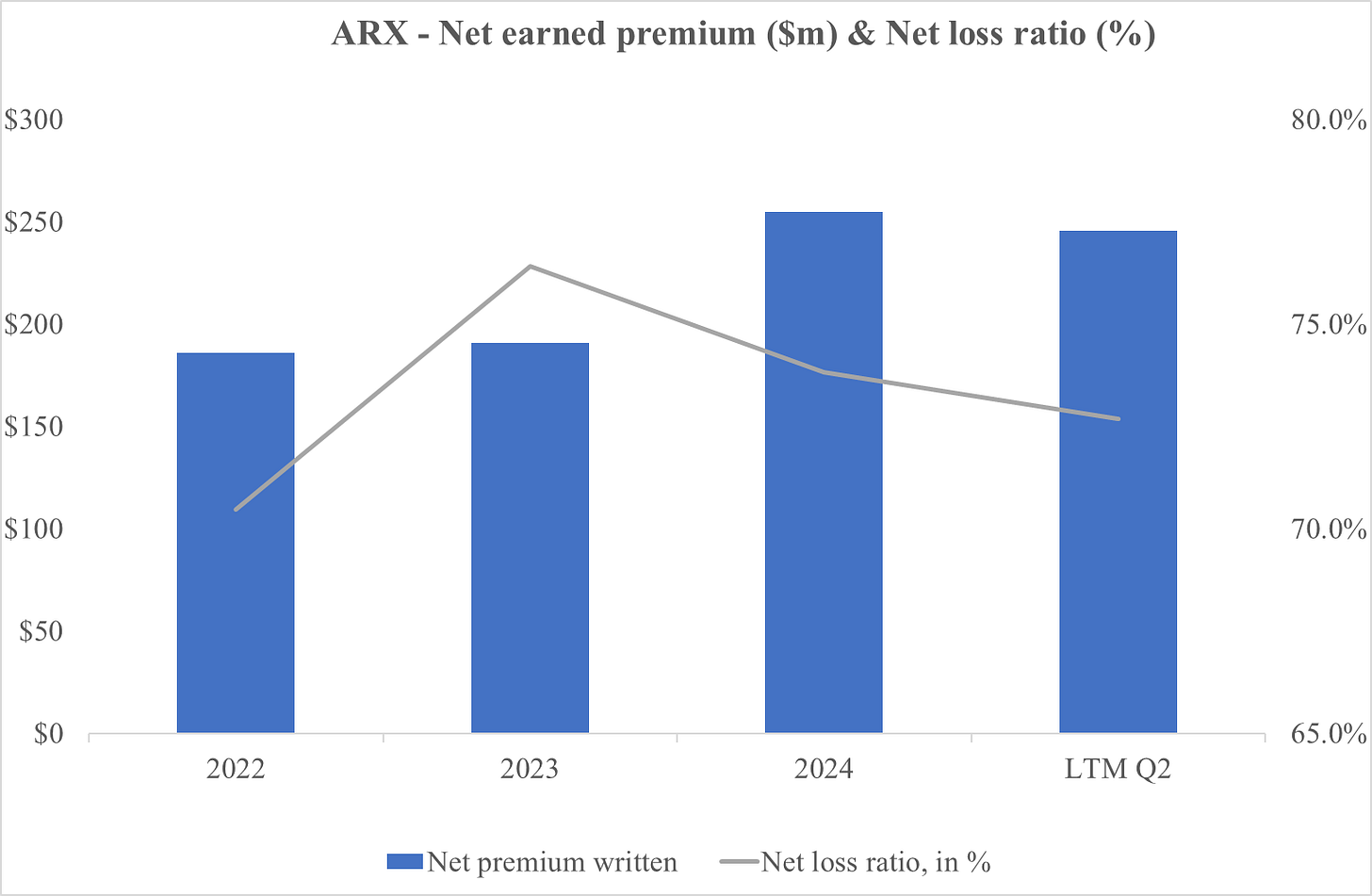

Since ARX was IPO-ed only recently, we have just a three-year window of detailed disclosure. In 12-months to June 2025 the company wrote $3.4bn of gross premium, retaining only about 7% and ceding the rest to reinsurers and alternative capital providers. Management targets a net retention of around 10%, enough to demonstrate ‘skin in the game’ while still keeping balance sheet exposure limited. Apparently, the sidecar Flywheel Re takes over roughly 30% of ceded premium.

In 2024, ARX generated $225m of net earned premium, growing at about 25% per year, with a net loss ratio near 73%. That figure is broadly in line with industry averages (typically 60–75% depending on the line of business) but compares unfavourably to best-in-class specialty carriers in the SME commercial space like Kinsale, which runs closer to the mid-50s.

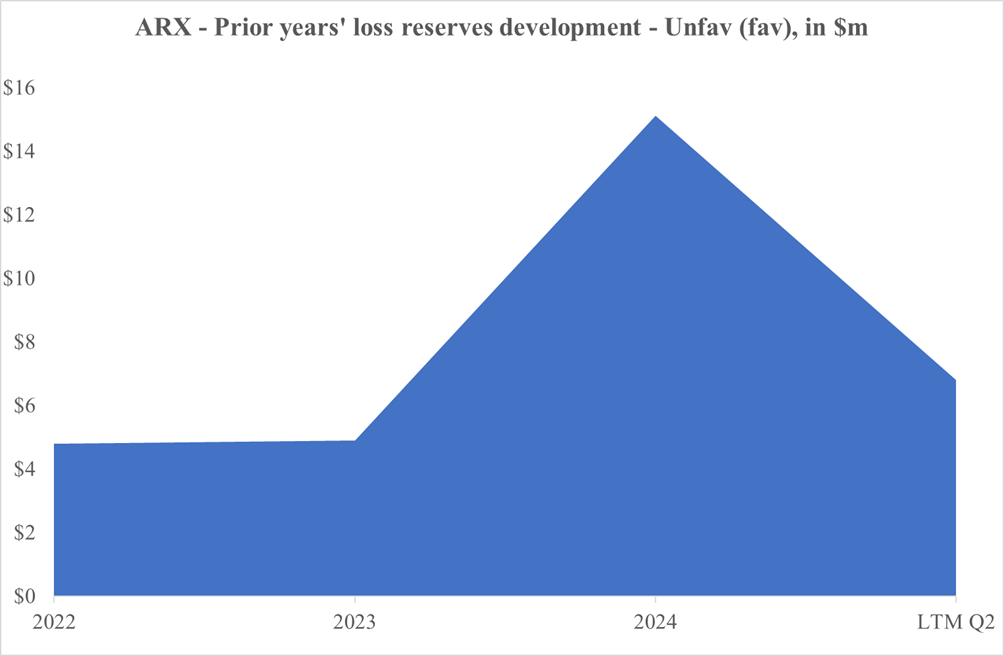

ARX does not disclose a full combined ratio on its retained specialty book, but given the loss ratio, it is likely in the 95–100% range. Reserve development has also been a modest headwind. Since inception, ARX reported unfavourable development with roughly 4%-pts of net earned premiums added each year. Management exited certain liability and property lines in the UK and Europe to stem the drag. Still, the long-tail nature of liability means some of that pain could linger. Something to watch with caution.

Taken together, ARX’s underwriting performance is solid enough to deliver profitable results for its risk partners, but not exceptional when viewed in isolation. Its true value lies less in stand-alone underwriting process and more in how the insurance operations integrate into the broader ARX risk exchange model.

Management & culture

When it comes to leadership, I like the fact that ARX was launched by three industry veterans: Jeff Radke (57), Chris Lee-Smith (57), and Frank O’Neill (52). Each brings more than three decades of experience from global insurers and brokers such as Guy Carpenter, WTW, Aon, Swiss Re, and Argo Group. The company’s leadership combines deep insurance pedigree with a start-up mindset — a mix that is rare and valuable.

Jeff Radke, now CEO, offers a particularly instructive backstory. He once led PXRE, a Bermuda reinsurer specializing in catastrophe and excess-risk business, taking over from his father Gerald in 2003. After Hurricanes Katrina, Rita, and Wilma inflicted severe losses, PXRE went into run-off and was eventually merged into Argo Group, where Radke worked closely with Chris Lee-Smith. It is hard not to see that experience leaving its mark: ARX today deliberately avoids Nat Cat tail risks, reflecting scars earned the hard way.

Now comes the part of the story where things get more complicated. ARX completed its IPO on July 24, 2025, pricing at $21 per share and raising about $400m in proceeds from new shares. Another ~$400m came from existing shareholders who sold part of their stake.

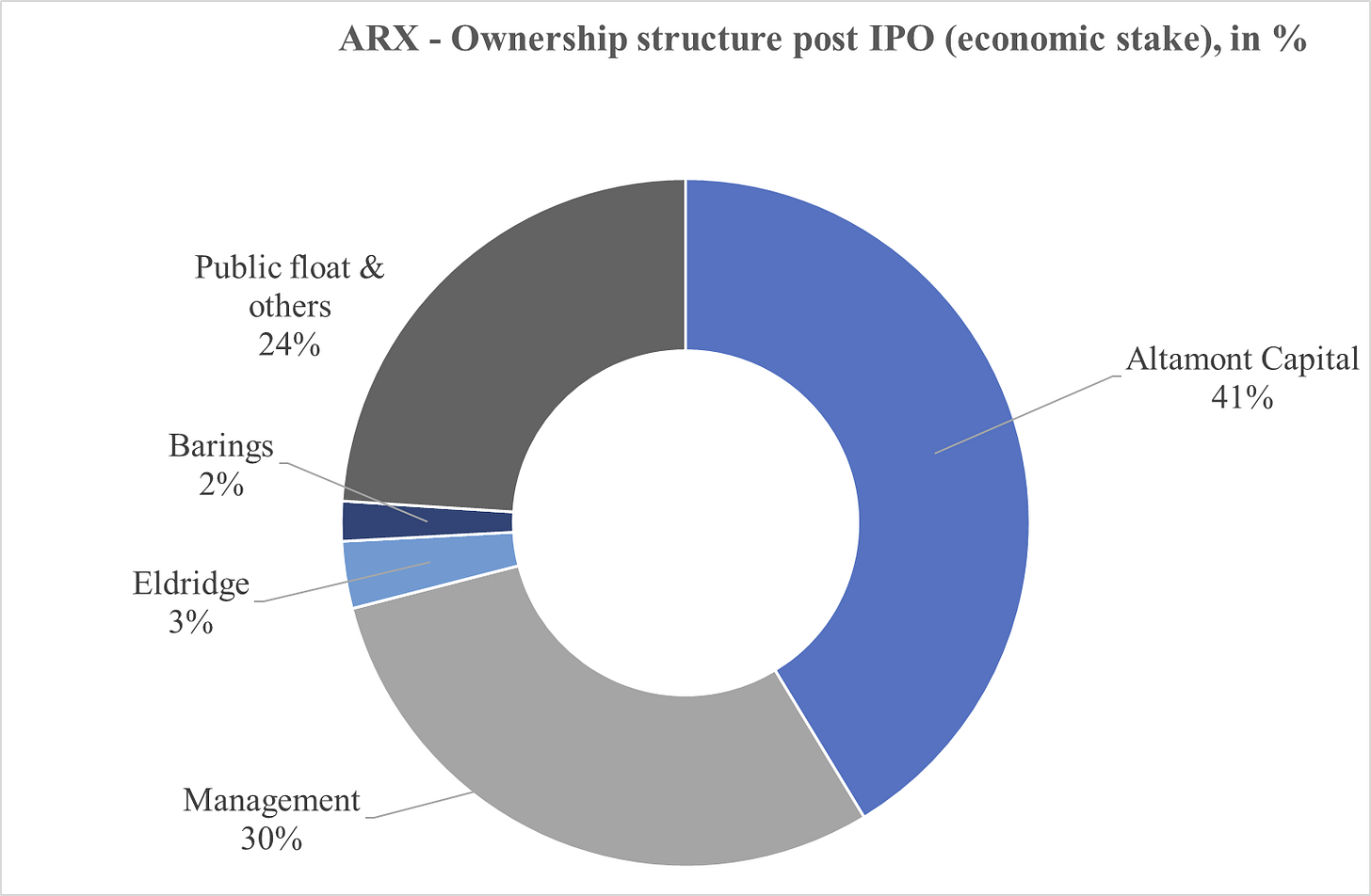

Post-IPO, the shareholder base is dominated by Altamont Capital, a California-based private equity firm with +$4bn AUM and reputation for being founder-friendly and operationally engaged. The PE fund owns around 41% of the economic interest but controls nearly 77% of the votes via Class B super-voting shares (10 votes per share). This makes Accelerant a “controlled company” under NYSE rules.

Source: My estimate based on 10-Q and S 1/A filings.

The founders themselves still own close to 30% of the economics, though only about 5.5% of the votes. If newly granted RSUs and options are fully vested and exercised, their stake could rise toward ~38% (economics) and ~8% (voting). Other notable investors include Baring (a global investment manager owned by MassMutual) and Eldridge (a company owned by Todd Boehly), both minority holders and also participants in the Flywheel Re sidecar.

This ownership setup cuts both ways. On the positive side, ARX’s capital and long-term orientation gave management the runway to build ARX methodically, without rushing for short-term results. On the negative side, governance is tilted heavily toward Altamont Capital. Public shareholders have limited say in board composition, strategic decisions, or potential related-party deals. There is also the looming risk of share dilution (ca. 200m shares with a lock-up of 180 days pointing to January 2026) as well as share overhang as the private fund eventually sells down its position.

The most sensitive governance issue so far has been related-party transactions. Following Q2 2025 results, ARX’s stock dropped by almost 30%, erasing its post-IPO premium. The main trigger: Investor unease around a link to Hardon Specialty Insurance, a fronting insurer launched by the same majority shareholder Altamont Capital. Hardon accounted for $170m or 16% of ‘independent members’ exchange premium in Q2, raising questions about ARX’s reliance on an affiliate of its controlling shareholder. Management insists these arrangements are arm’s length and points out that Hardon’s share of premiums should decline as the platform diversifies. Still, the optics of such concentration have weighed on confidence, with some investors asking whether ARX can truly stand on its own in attracting third-party risk capital.

Culturally, ARX feels different from the average insurer. It combines the entrepreneurial energy of a fintech with the rigor of underwriting discipline. Radke describes the mission as “bringing transparency, data, and shared incentives back… serving MGUs as important partners… making it easier and more efficient to exchange risk.”

The company runs with a partner-centric, lean and decentralized style. Most of employees work remotely. Decisions are data-driven, but the emphasis is on alignment: MGAs are treated less like counterparties and more like members of a shared ecosystem. This orientation has made ARX attractive to entrepreneurial underwriters seeking a home where their expertise is valued.

To conclude here, the leadership team is strong, with founders still holding a meaningful economic stake. Yet real control lies with Altamont Capital, whose dual-class structure and related-party dealings have already raised concerns. The cultural DNA of ARX is promising — transparent, analytical, entrepreneurial — but questions of governance and independence remain unresolved, and these weigh heavily on the stock.

Competition

There are no true public comparables with the same ‘risk exchange’ model as ARX. Still, a few players echo parts of the approach. Trisura (TSX: TSU) is a fast-growing fronting carrier in the U.S. and Canada, retaining little risk and ceding most to reinsurers, structurally similar to ARX’s carriers, though without the broader exchange layer. Ryan Specialty (NYSE: RYAN) operates as a wholesale broker and MGA platform; it doesn’t take balance sheet risk, but its MGUs and program business place it firmly in the same ecosystem. BRP Group (NASDAQ: BWIN) is primarily a broker, yet its MGA/MGU segment also targets SME specialty programs, though with less of an exchange feel. Beyond the public names, there are long-standing MGA operators such as State National (acquired by Markel in 2017), as well as newer privately held MGA and fronting companies.

Valuation

ARX currently trades at forward multiples of ~14x EV/EBITDA, ~30x P/E, and ~12.6x P/B. These levels reflect high investor expectations for scalable growth. Relative to peers, the valuation sits toward the upper end.

A simple sum-of-the-parts framework helps me break the business down:

Risk Exchange: Fees based on the volume of exchange written premium

MGA operations: Net commission on the volume of exchange written premium placed by partially or fully owned MGAs

Insurance operations: Underwriting result on retained specialty risk and ceding commission on ceded business to risk partners

Off-balance sheet value of incubated MGAs: As of June 2025, Accelerant held equity interests worth about $40m in affiliated MGAs/TPAs, and management has guided to its first minority stake sale by year-end—likely generating $25–30m of incremental adjusted EBITDA.

From this, I see three broad outcomes:

Base case:

If ARX compounds revenue at ~35% through 2030 and reaches ~$3.6bn, with ~15% net margins, net income would be ~$450m ($2.20 EPS). At 13x earnings, that implies a $5.8bn market cap, or $28 per share (IRR of 6%).

Blue sky:

Should the platform exceed expectations, building trust as the dominant MGA ecosystem, revenues could top $6bn with ~20% margins, yielding $1.0–1.2bn in net income ($4.90 EPS). At 15x earnings, this suggests ~$15bn market cap, or $74 per share (IRR of 27%).

Pessimist case:

If growth stalls or underwriting falters, net income might be just $70m by 2030. At 13x, that equates to ~$1.1bn market cap, or $5/share (IRR –24%), or $5 per share (IRR of -24%)

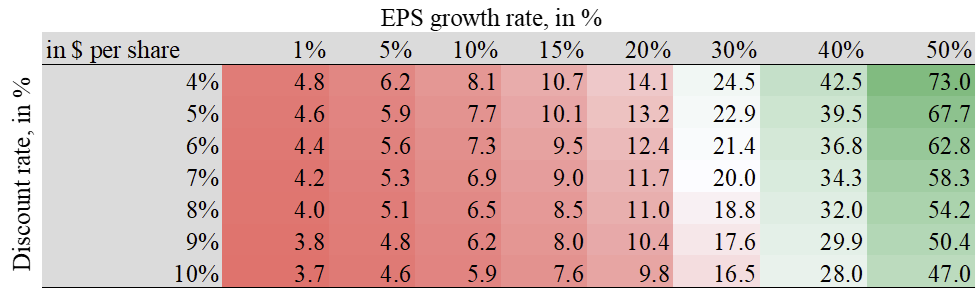

A simple sensitivity of forward EPS growth to interest rates:

Source: My calculation assuming 10 years forward EPS growth. No terminal value.

Why does the opportunity exist?

In part because investors remain cautious. Governance is heavily tilted toward Altamont Capital, which retains over 70% of voting rights and has related-party ties that unsettle some. The stock’s float is limited. Memories of past “insurtech 1.0” debacles (remember Lemonade, Hippo, Vesttoo?) still haunt the sector. The model itself straddles MGA, carrier, and tech platform, making it harder to slot neatly into analyst coverage. And as a young public company, with profitability only since 2024, ARX has yet to build the multi-year track record many institutions prefer, especially at a time when the broader P&C cycle may be turning away from a hard market.

Catalysts:

Continued earnings growth, scale expansion with existing partners, adding new geographies (e.g. Canada or Australia) or new partners like captives, reduction on related-party reliance, fresh analyst coverage, potential index inclusion (Russell 2000/Midcap), or Altamont Capital broadening the float with new strategic investors.

Key risks

Governance overhang (PE controlling +70% voting rights, dual class of shares, complex related party relationships)

‘Smart money cashing out’ post IPO lock-up period

Pullback from MGAs & risk capital providers (poor underwriting, competitive concerns, fraud, etc.)

Regulatory & compliance risk (tighter regulation of MGAs industry and fronting carriers)

Competition

Valuation

Summary:

Accelerant reflects the shifting dynamics of specialty insurance, where technology and data are taking on a larger role. The company combines innovation with disciplined underwriting and is benefiting from favourable industry tailwinds. Still, questions linger around governance, related-party reliance, and whether profitable scale can truly be sustained. These are challenges that time and greater transparency may resolve, but for now they keep the story clouded. For me, that places Accelerant firmly on the ‘watch list’. If management continues to execute, the scepticism weighing on the stock today could become the source of tomorrow’s opportunity.

If you know the company well or see it differently, I’d be glad to exchange views.

Disclaimer: The material and analysis in details herein is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. All facts and statistics are from sources believed reliable, but are not guaranteed as to accuracy, completeness or timeliness in the information. The author has or had positions in the company and her positions may change over time without notice.